-

Emissions from steel production – responsible for roughly nine percent of global greenhouse gas emissions – plateaued in 2021, signaling a potential turning point and a strategic opportunity to accelerate the transition towards green steelmaking.

While this slowdown is due mainly to lower output rather than cleaner production routes, the sector now faces a pivotal moment: with 70 percent of blast furnaces due for reinvestment in the next decade, capital can be redirected towards near-zero technologies, turning the current moment into a springboard for green industrial growth.

-

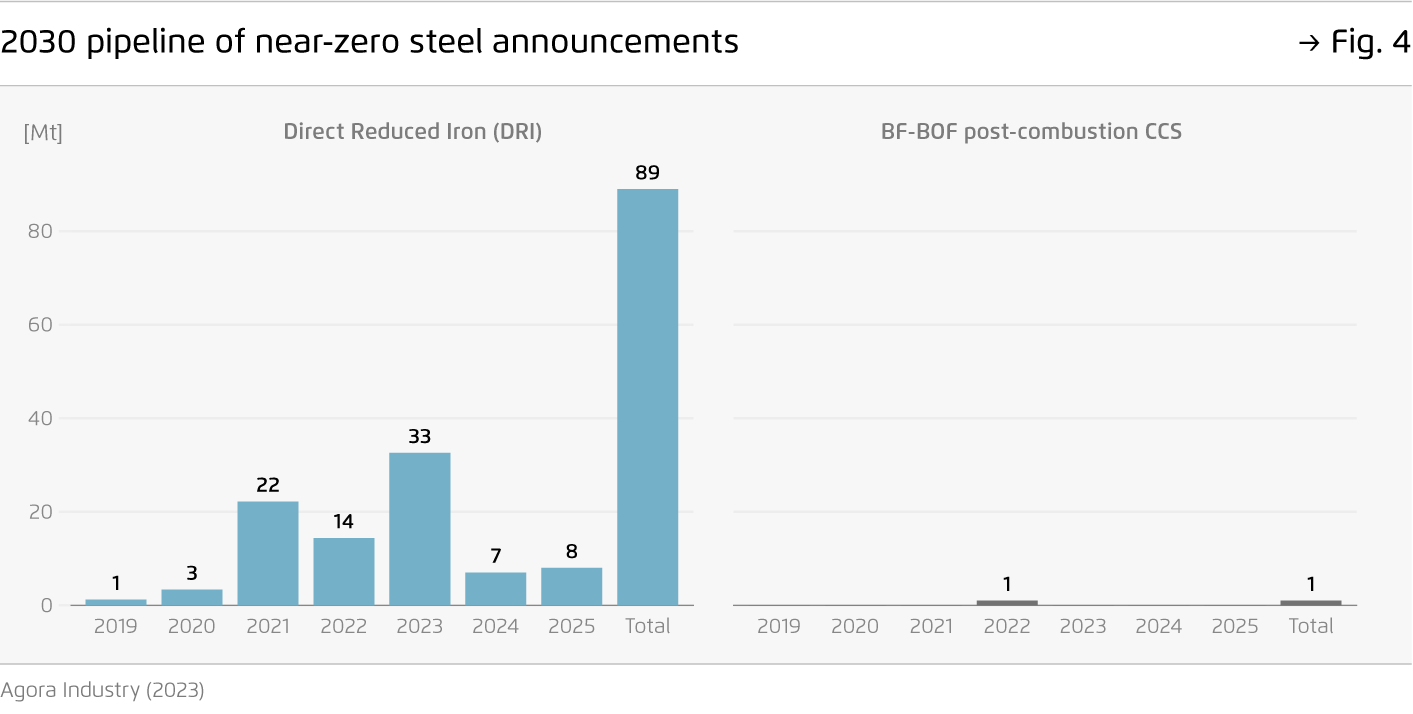

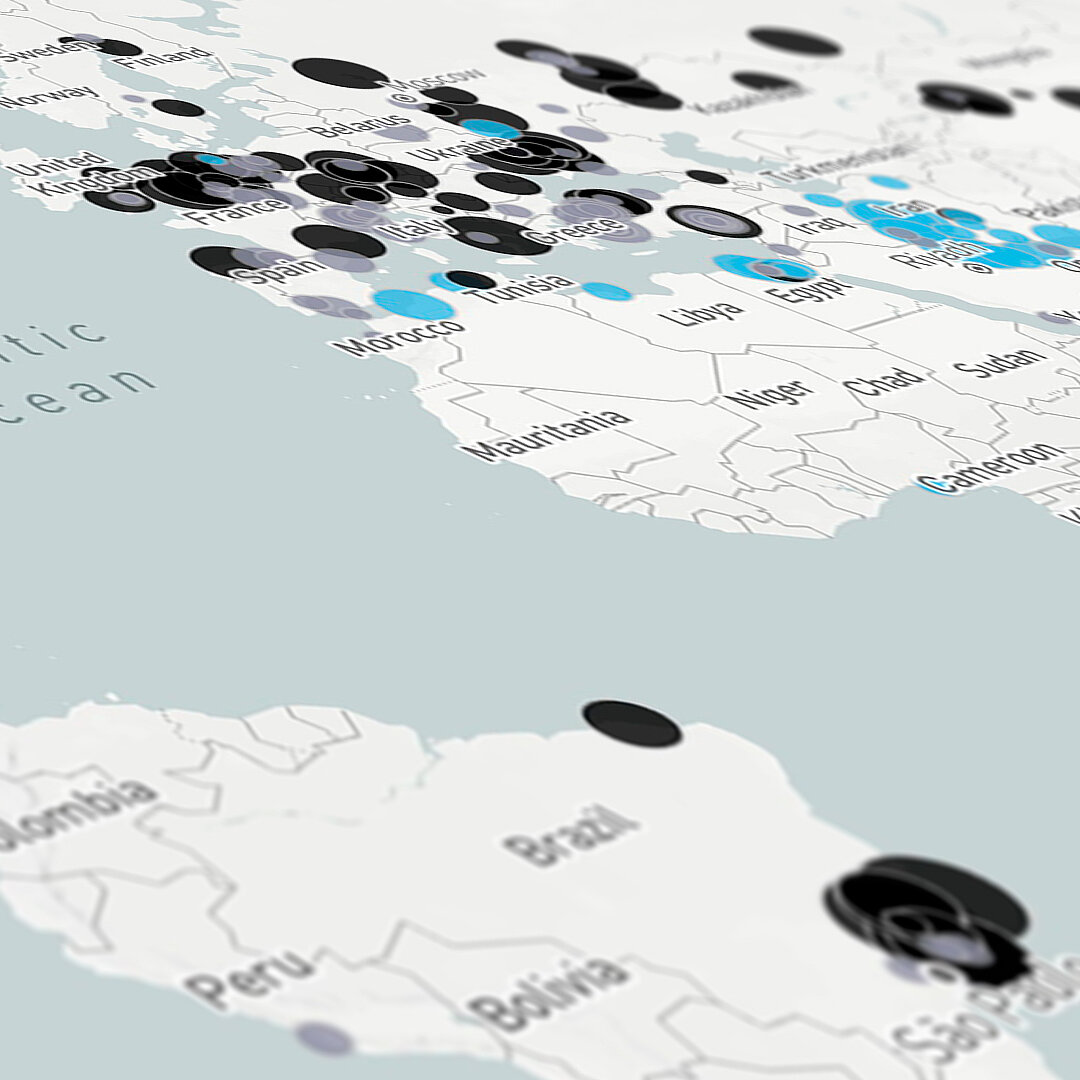

Hydrogen-based direct reduced iron (H₂-DRI) has become the leading technology for decarbonising primary steel.

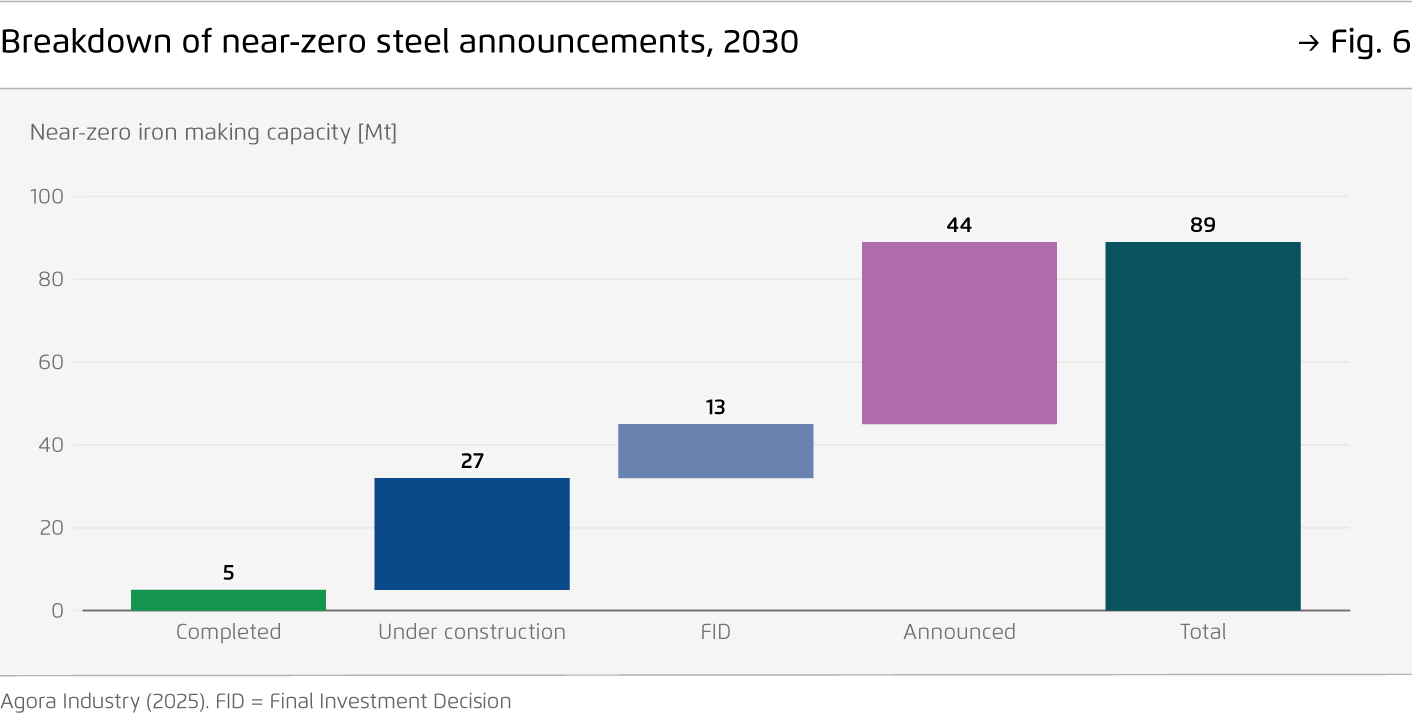

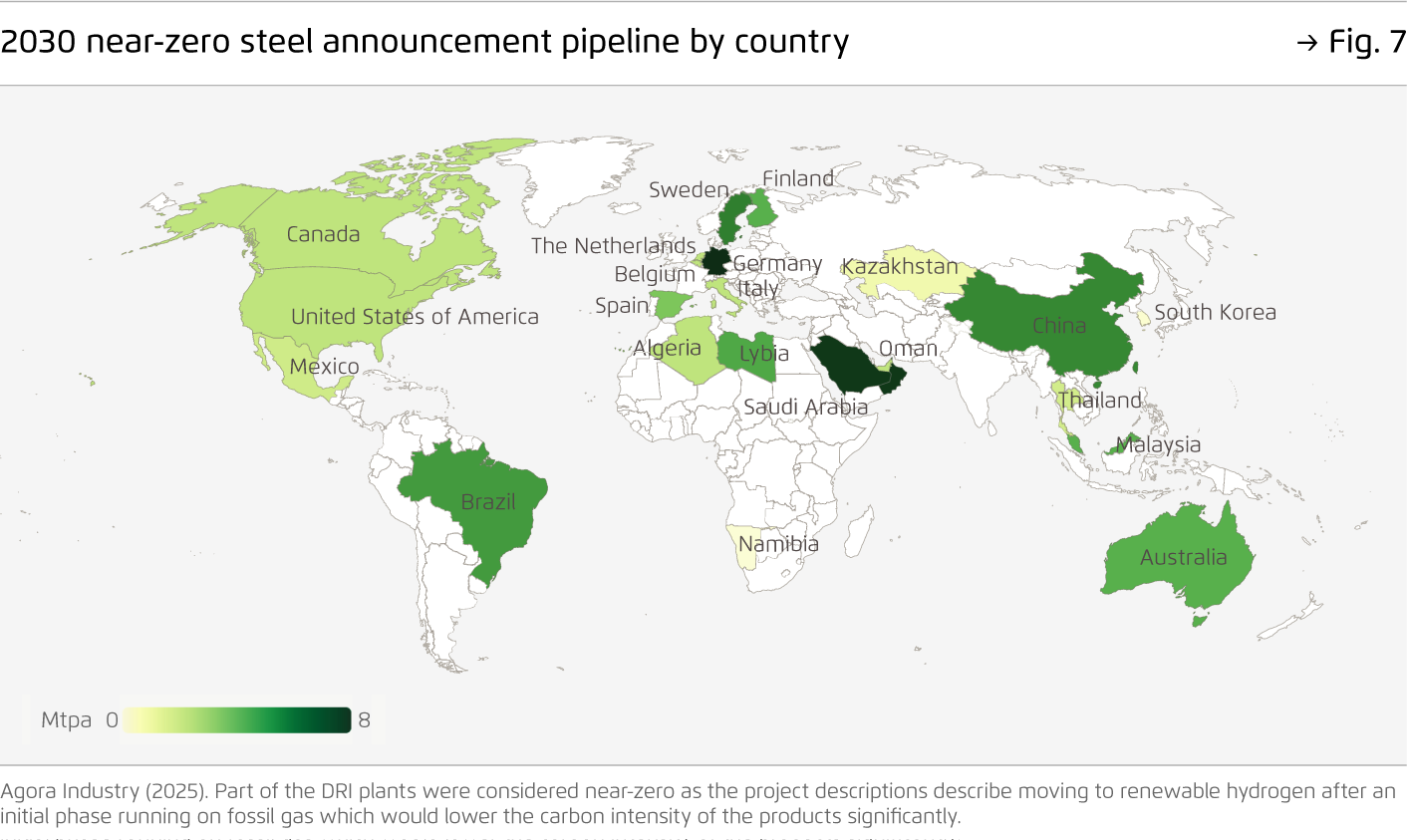

Announced capacity totals 89 million tonnes (Mt), with several projects under construction. While the proof of concept for H2-DRI is clear, technology development must be accelerated substantially to reach climate-neutral steel by mid-century. While low-carbon, scrap-based steelmaking could meet roughly half of 2050 demand, the rest must shift to H2-DRI – adding up to 1,000 Mt of near-zero ironmaking capacity.

-

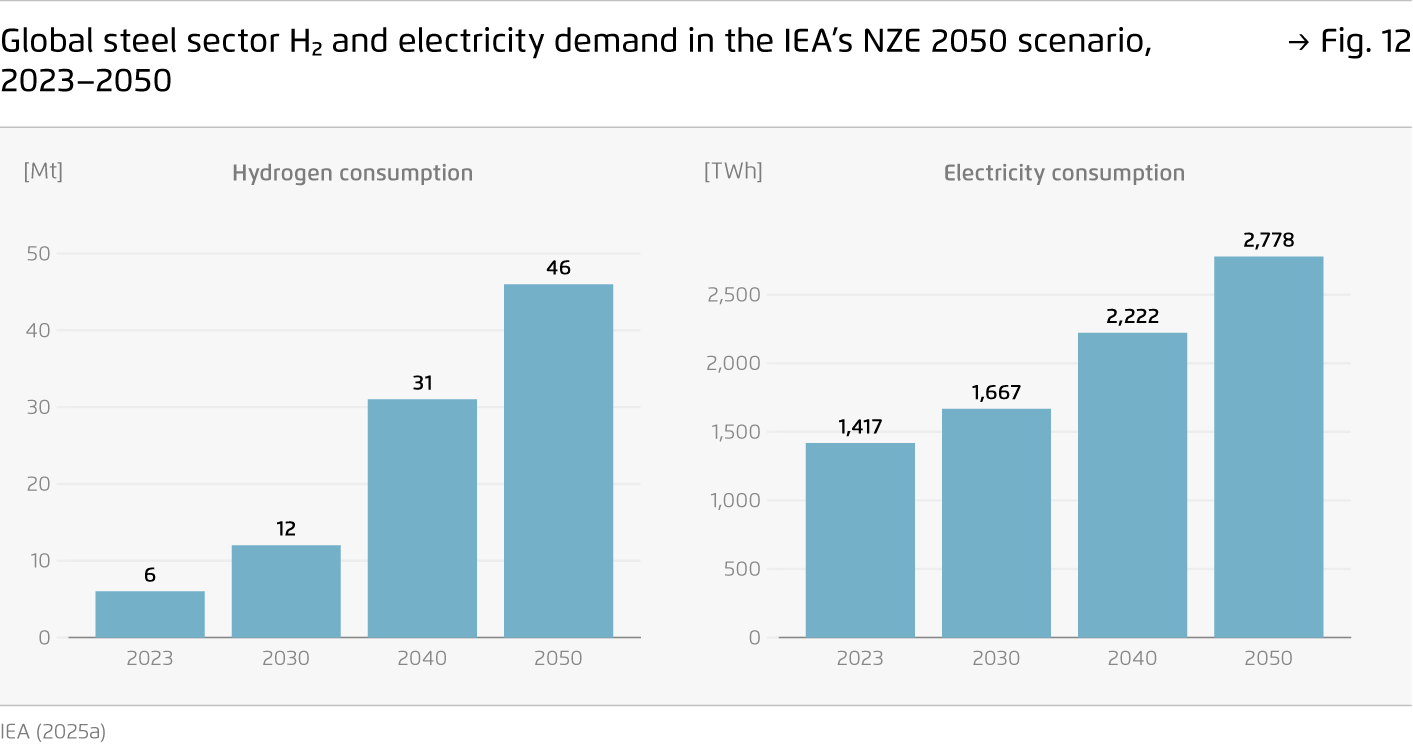

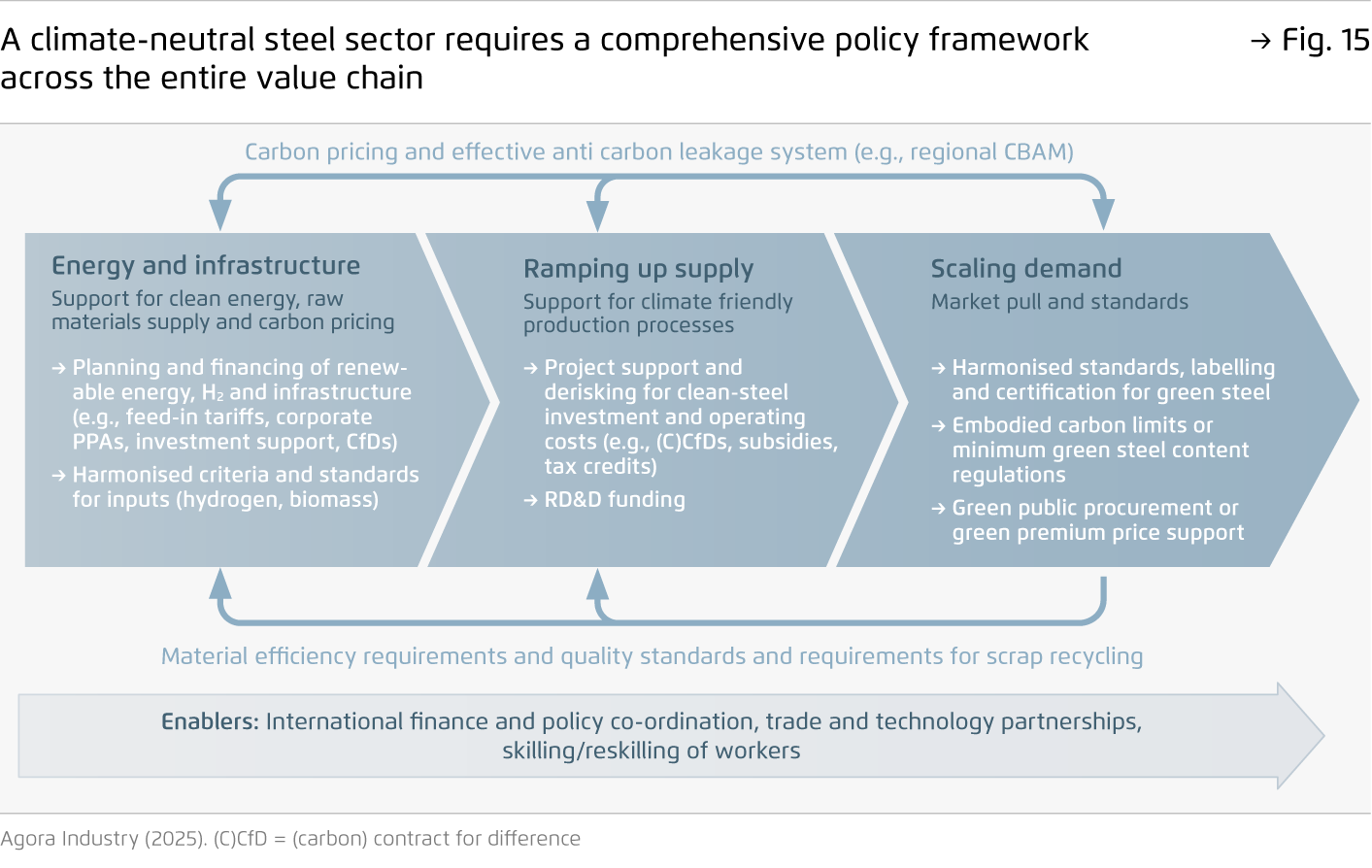

Achieving this large-scale H2-DRI capacity increase – up to 50 Mt a year by the late 2030s – will require international collaboration and domestic policy action across the value chain.

While the role of broad multilateral cooperation evolves, progress can be built through pragmatic partnerships and alignment among governments, international bodies, steelmakers and buyers – through establishing clean value chains or clear standards for green iron and steel. Domestically, supportive policy frameworks can accelerate investment, reduce risk and stimulate demand to create a viable business case for climate-neutral steel.

-

Once static among heavy emitters, the iron and steel sectors now have producers emerging as global leaders in transforming industry.

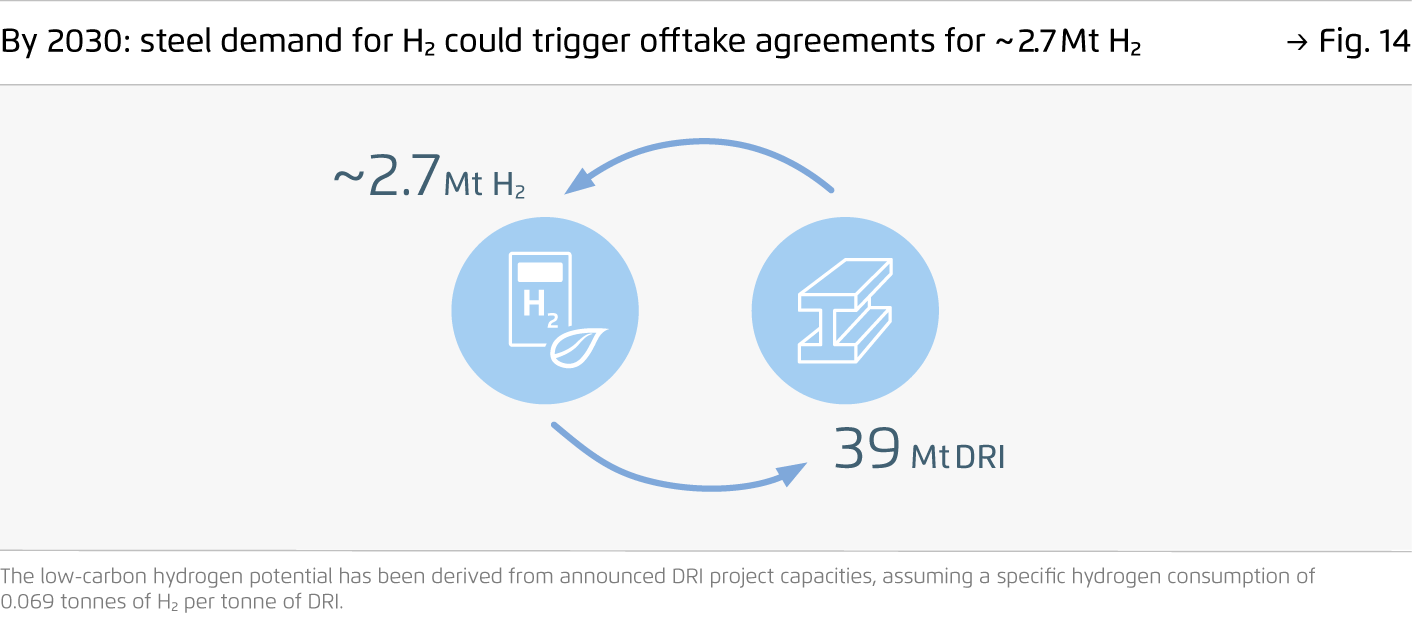

Countries with established steel industries can build resilient, next-generation steelmaking by defining clear pathways to climate neutrality. Emerging producers have the opportunity to develop competitive, clean steelmaking industries from the outset – driving a global shift towards green heavy industry. As a major anchor for green hydrogen demand, the steel sector’s transformation can also create multiplier effects that unlock investments across other industries.

Achieving climate-neutral steel by 2050

How the steel sector can shift from coal-based to clean production

Summary

Steel is the backbone of the modern economy – and the climate transition. Responsible for around nine percent of global carbon emissions, the sector must decarbonise rapidly to stay on track to climate neutrality by 2050. This policy brief distils new analysis into a practical roadmap to cut emissions while boosting competitiveness, investment and resilient jobs.

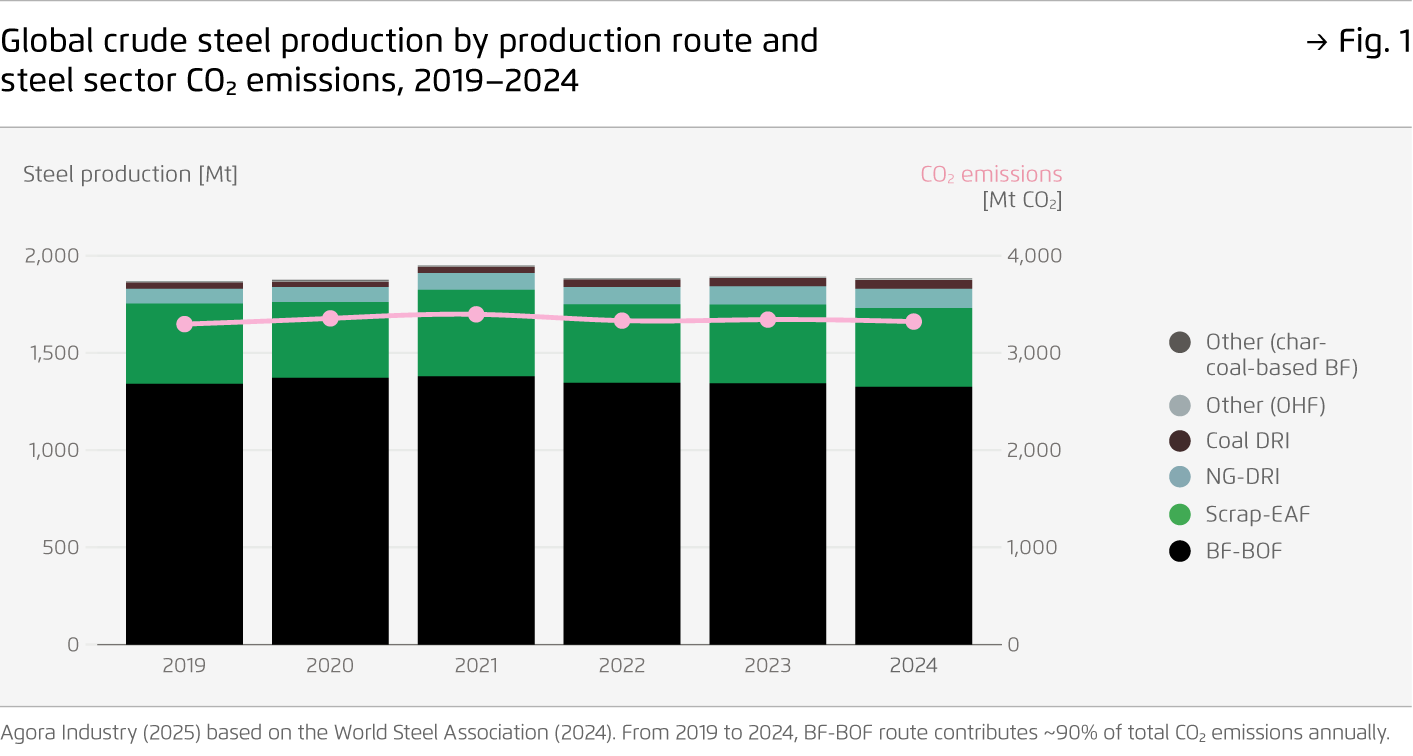

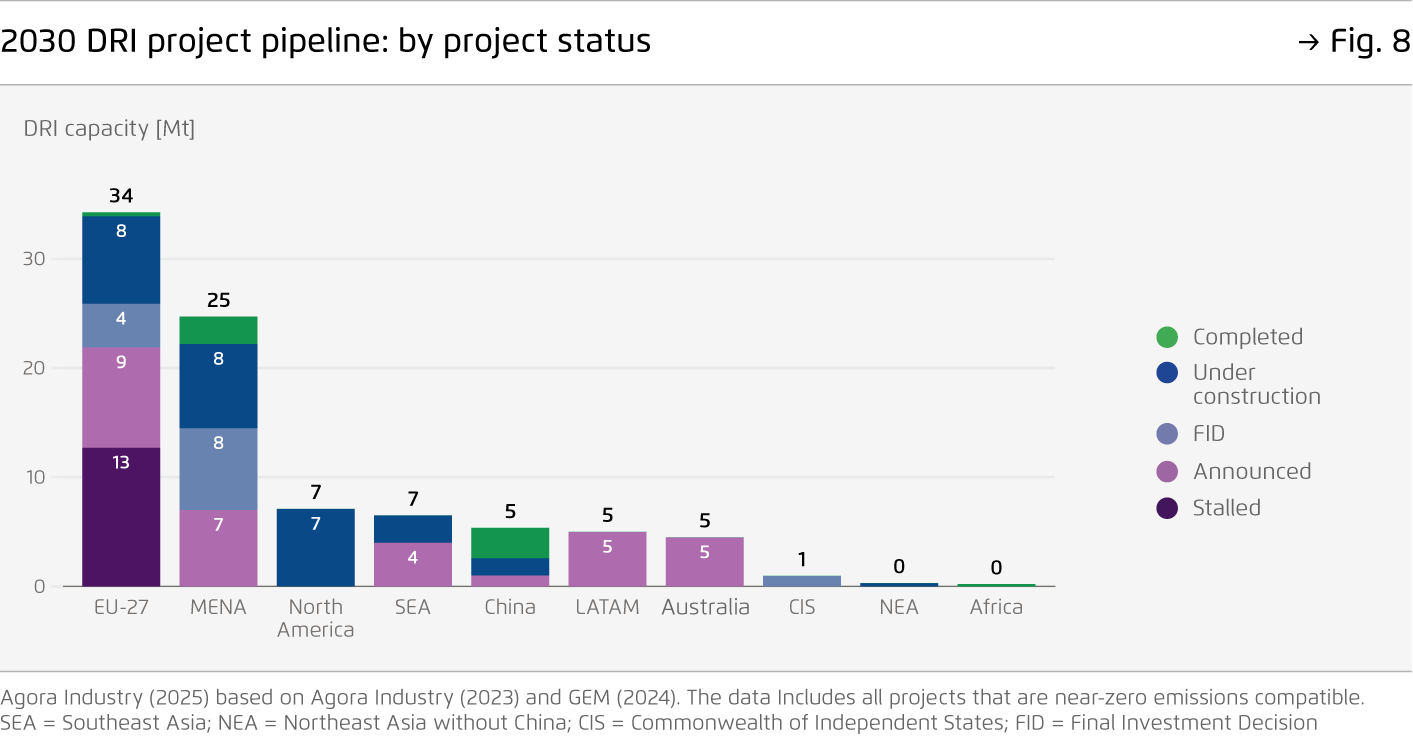

Global steel emissions appear to have peaked in the early 2020s and are now around one percent below 2021, but the dip reflects lower output, not cleaner production. Routes remain largely unchanged— around 70 percent coal blast furnace-blast oxygen furnace (BF-BOF), around 22 percent scrap-based electric arc furnace (EAF) and around 8 percent direct reduced iron (DRI)-EAF – so any demand rebound risks higher emissions. Durable cuts require rapid deployment of near-zero capacity that can replace integrated blast furnaces.

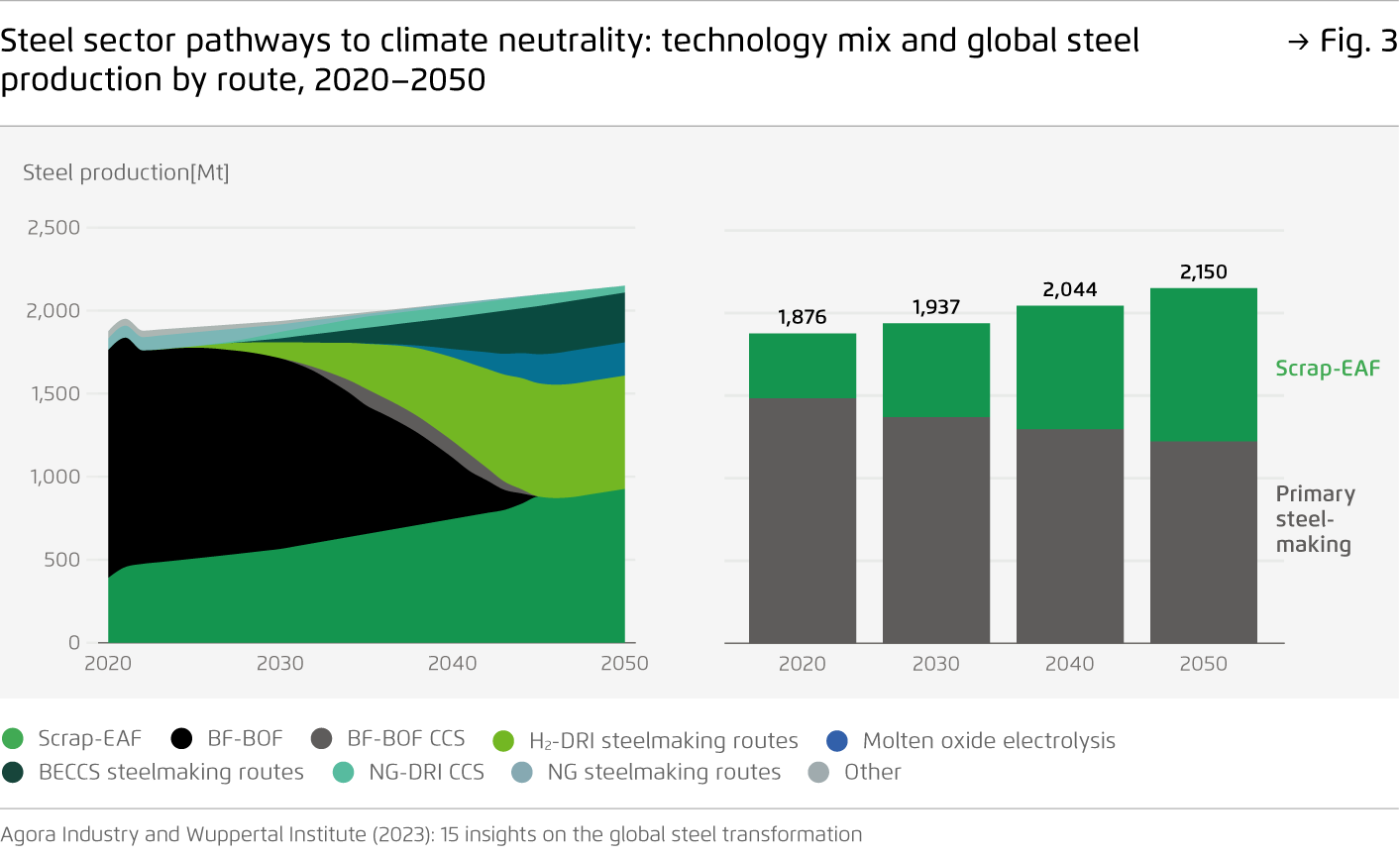

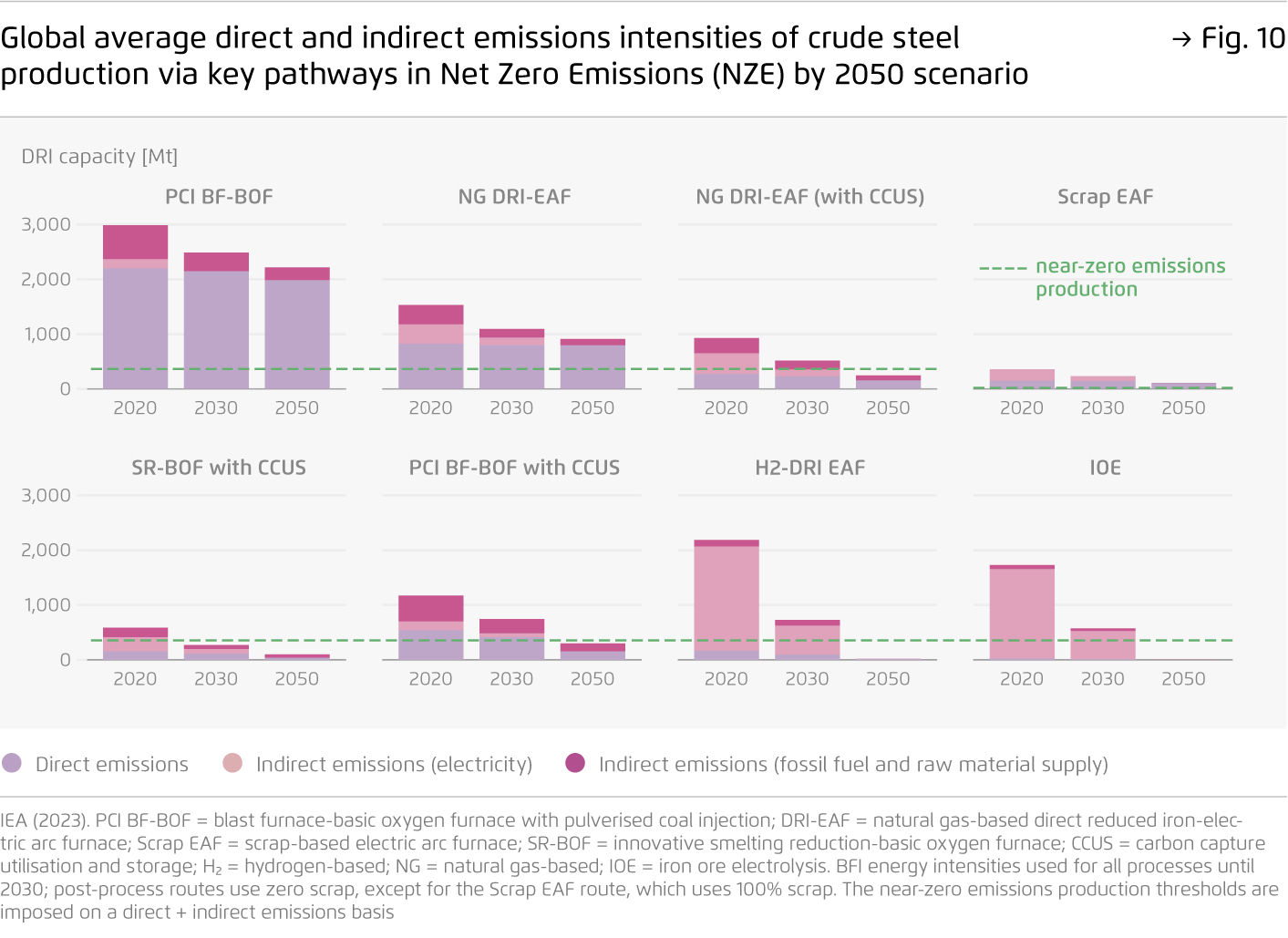

By 2050, scrap-based steel can supply 40 to 50 percent of output of around 1,000 million tonnes (Mt) per year. With demand likely at around 2,175 Mt per year, the rest will have to come from clean primary production. Hydrogen-based DRI plus EAF is the only commercially mature route with a credible line of sight to deep decarbonisation at scale before 2050 when compared to other technological routes like electrolytic ironmaking, BF-BOF with carbon capture and storage (CCS) and fossil gas-based DRI, which must switch eventually to clean hydrogen.

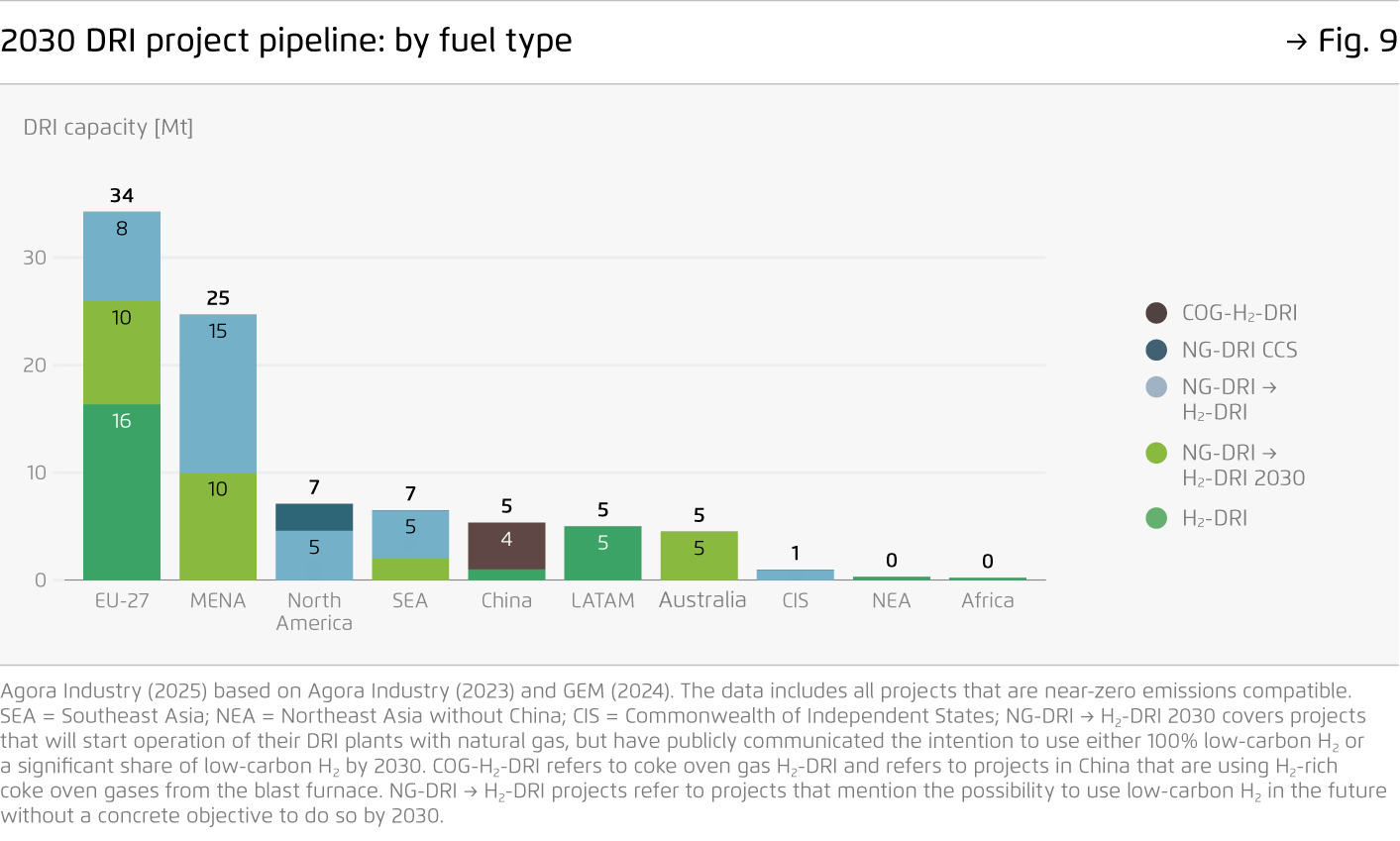

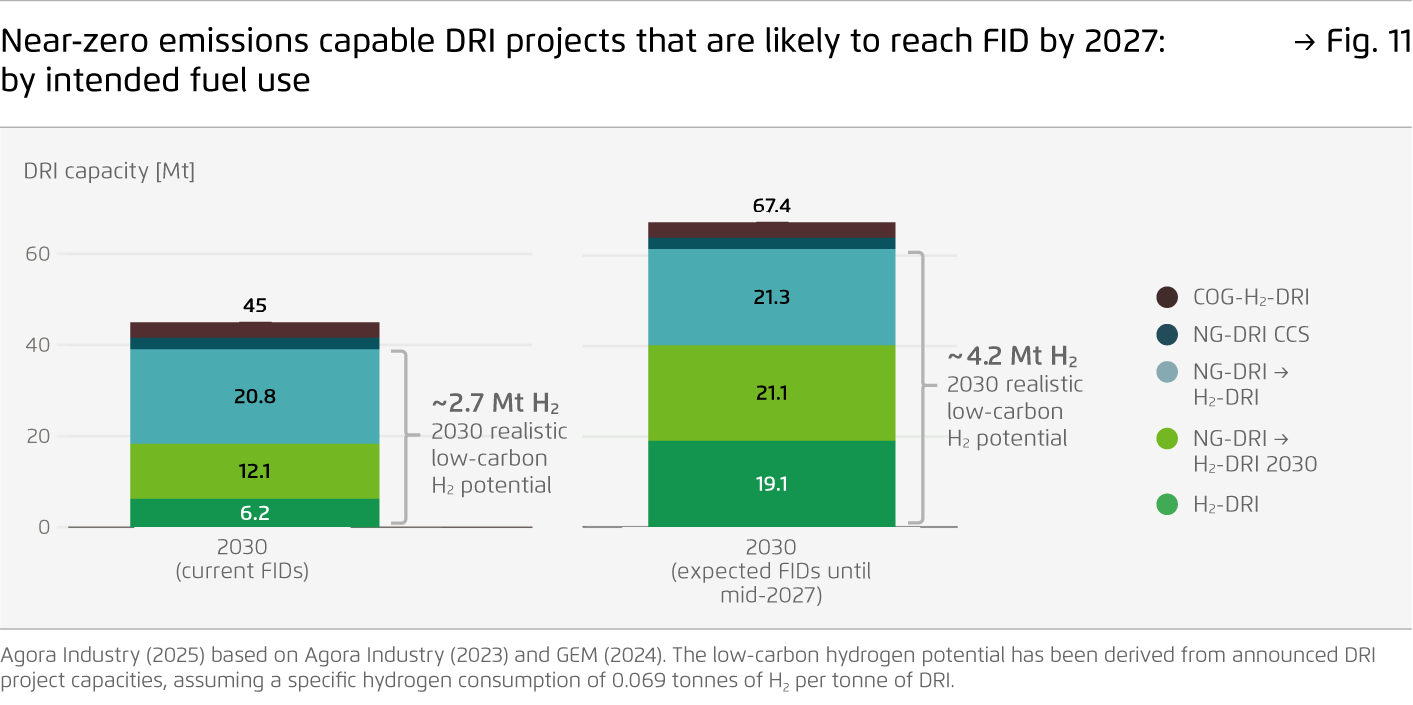

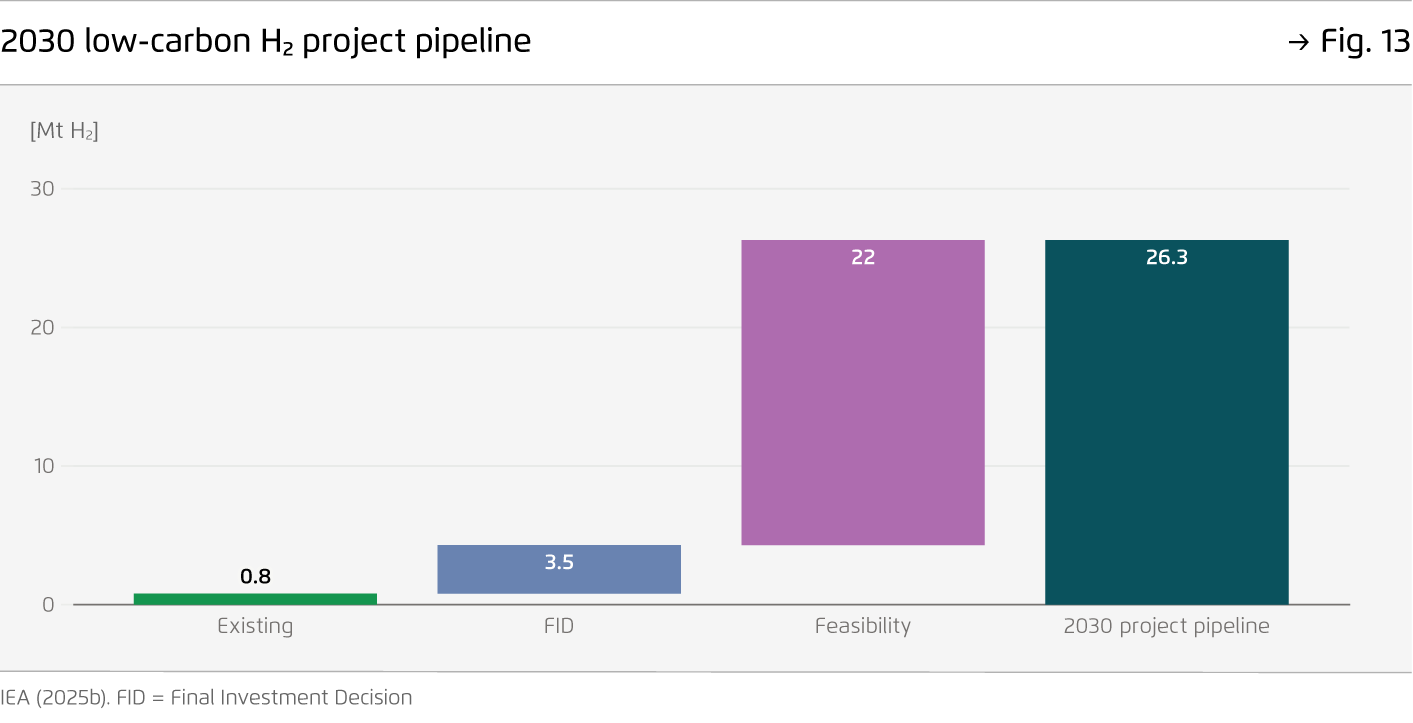

Scale matters: global DRI additions should average 50 Mt per year after 2035, with three- to four-year build times requiring a continuous project pipeline. There are currently 89 Mt in the project pipeline, not yet enough to enable a breakthrough amount of 100 Mt of green (climate-neutral) steel by 2030. Enablers include low-cost renewables and stronger grids, bankable hydrogen supply or hot briquetted iron (HBI) trade and access to DR-grade ore.

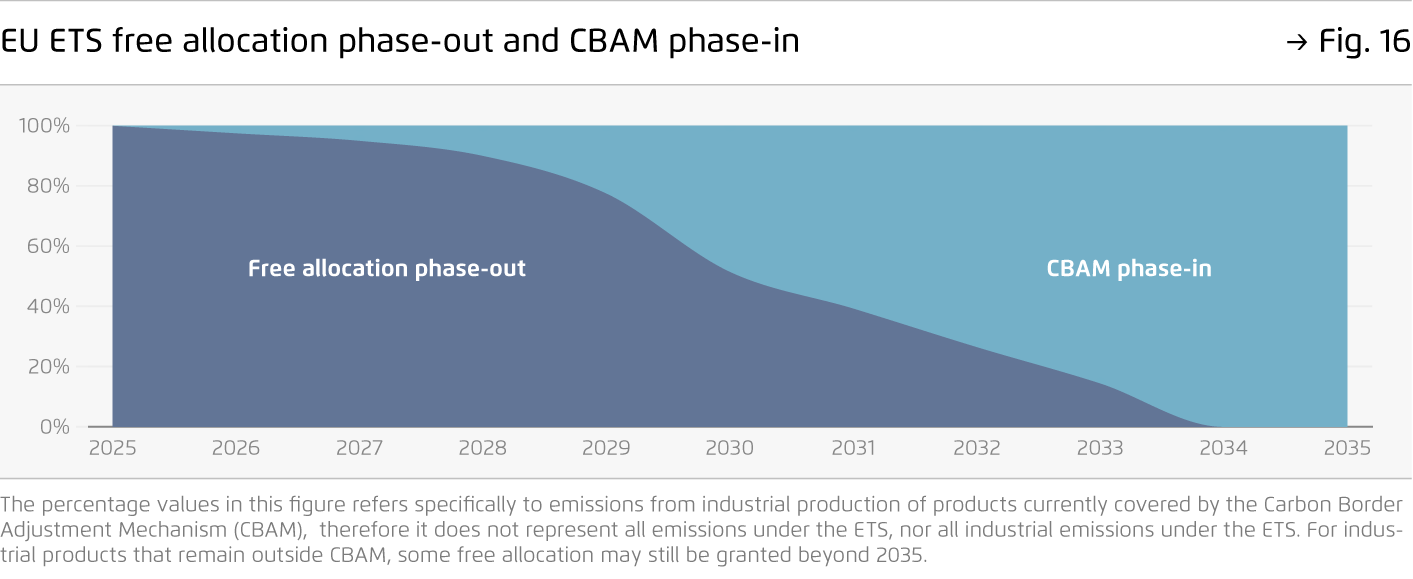

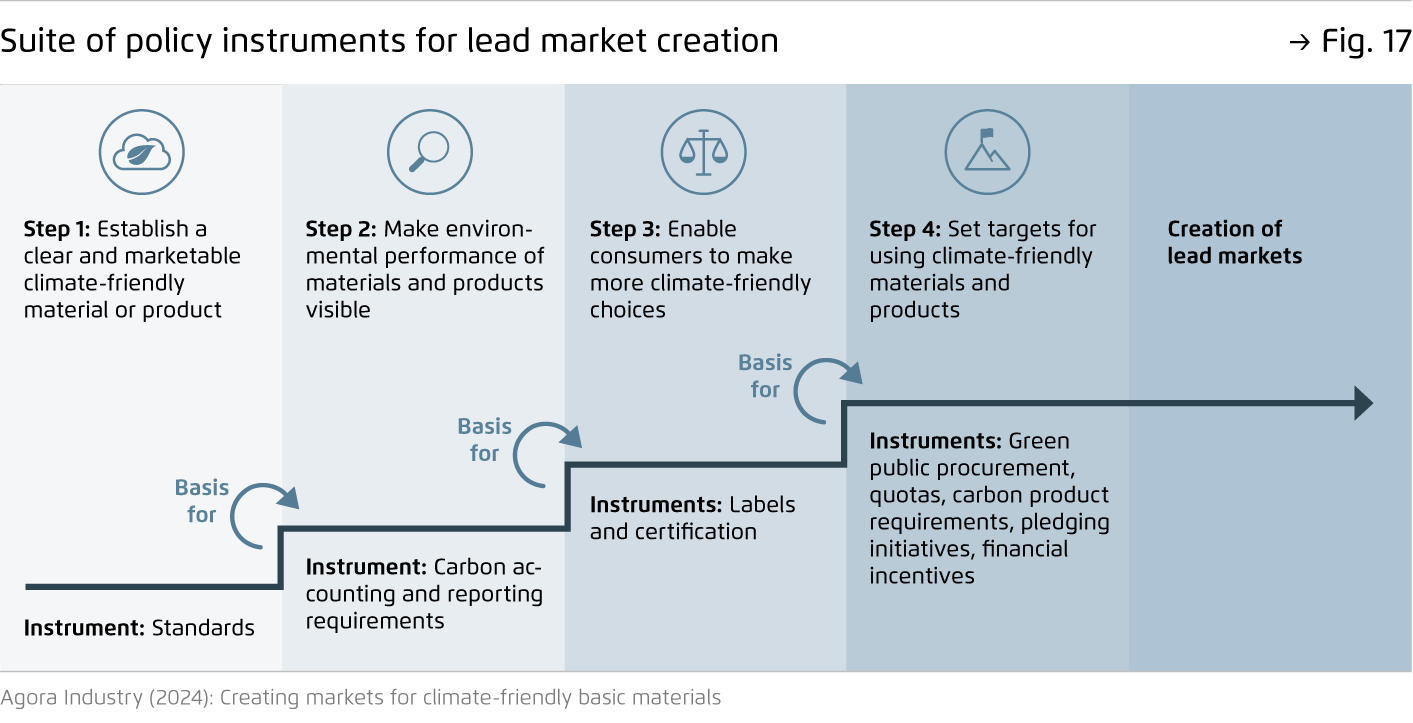

A policy toolkit along the entire value chain is needed to unlock these investments. (Carbon) contracts for difference ([C]CfDs) to bridge operating gaps, green public procurement, robust product standards and monitoring reporting and verification (MRV) defining near-/net-zero steel, and scrap quality/circularity standards. HBI trade can accelerate progress for importers, alongside partnerships, de-risking and targeted finance. Managing overcapacity, aligning standards and advancing plurilateral carbon leakage solutions will anchor a resilient, competitive steel base for clean power, mobility and manufacturing.

Key findings

Bibliographical data

All figures in this publication

Global crude steel production by production route and steel sector CO₂ emissions, 2019–2024

Figure 1 from Achieving climate-neutral steel by 2050 on page 8

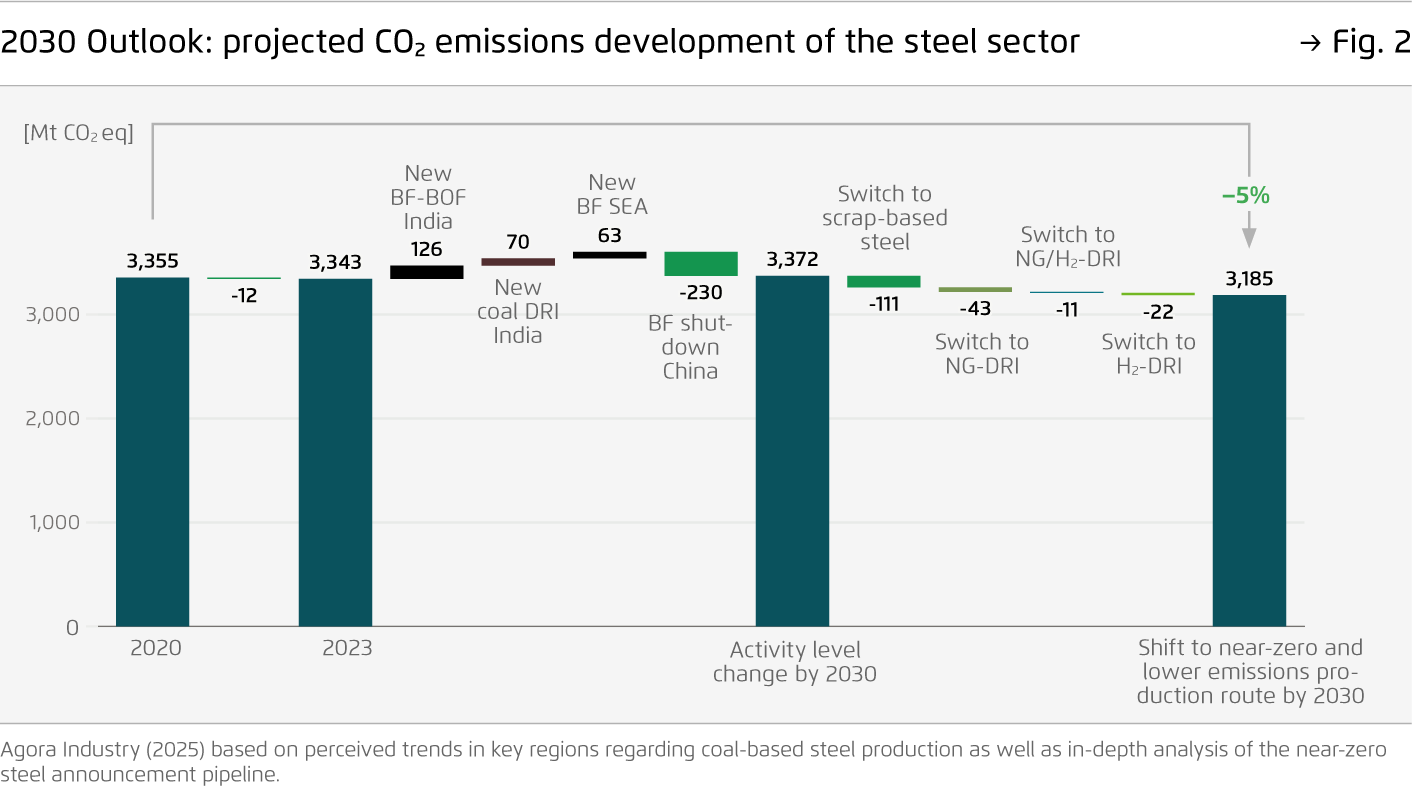

2030 Outlook: projected CO₂ emissions development of the steel sector

Figure 2 from Achieving climate-neutral steel by 2050 on page 9

![The global steel industry can achieve net-zero emissions by the early 2040s [Translate to English:]](/fileadmin/_processed_/8/f/csm_15_insights_global_steel_news_73f640a802.jpg)

![Shifting global steel reinvestments from coal to clean [Translate to English:]](/fileadmin/_processed_/9/e/csm_global-steel_project_news_2_283e600f74.jpg)