-

Southeast Asia is emerging as a key player in the global steel value chain.

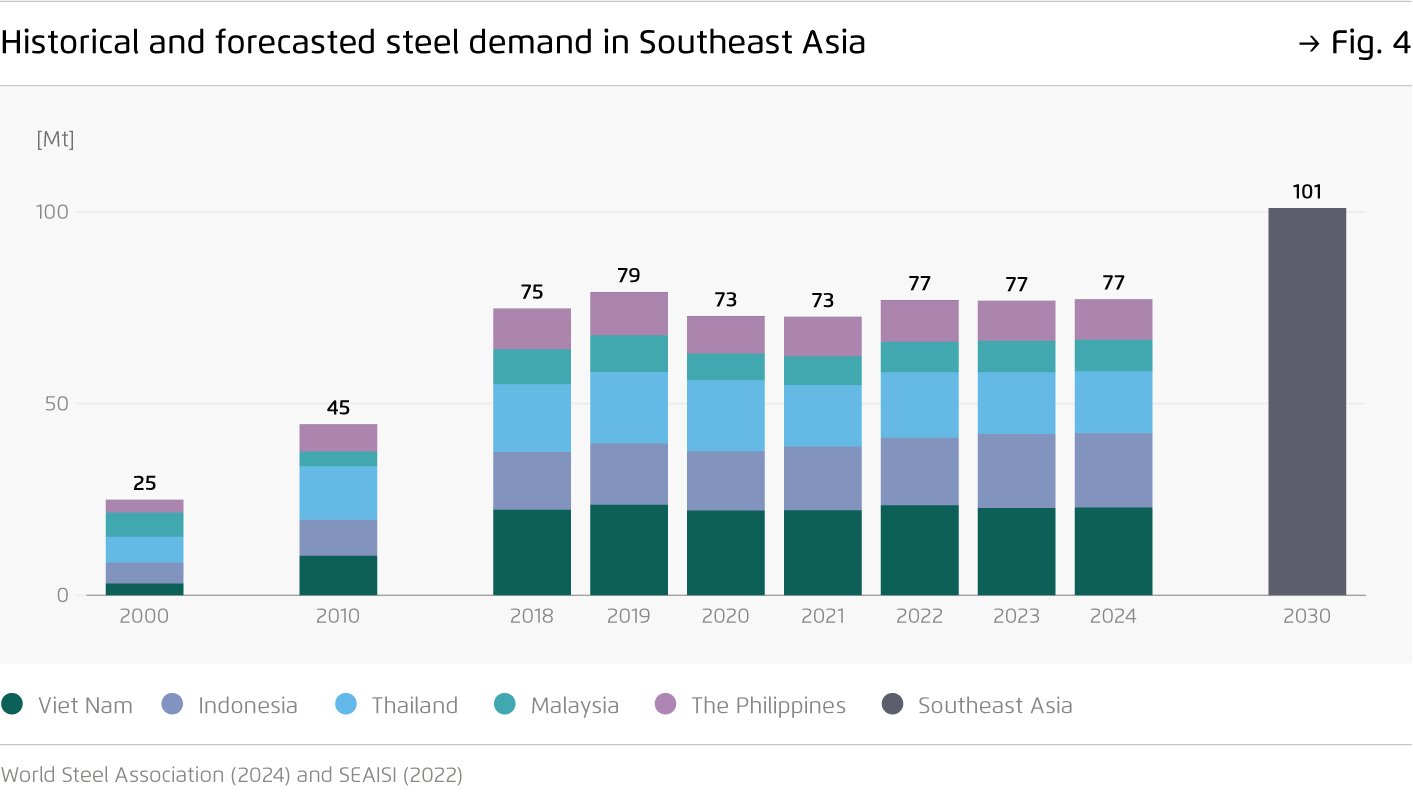

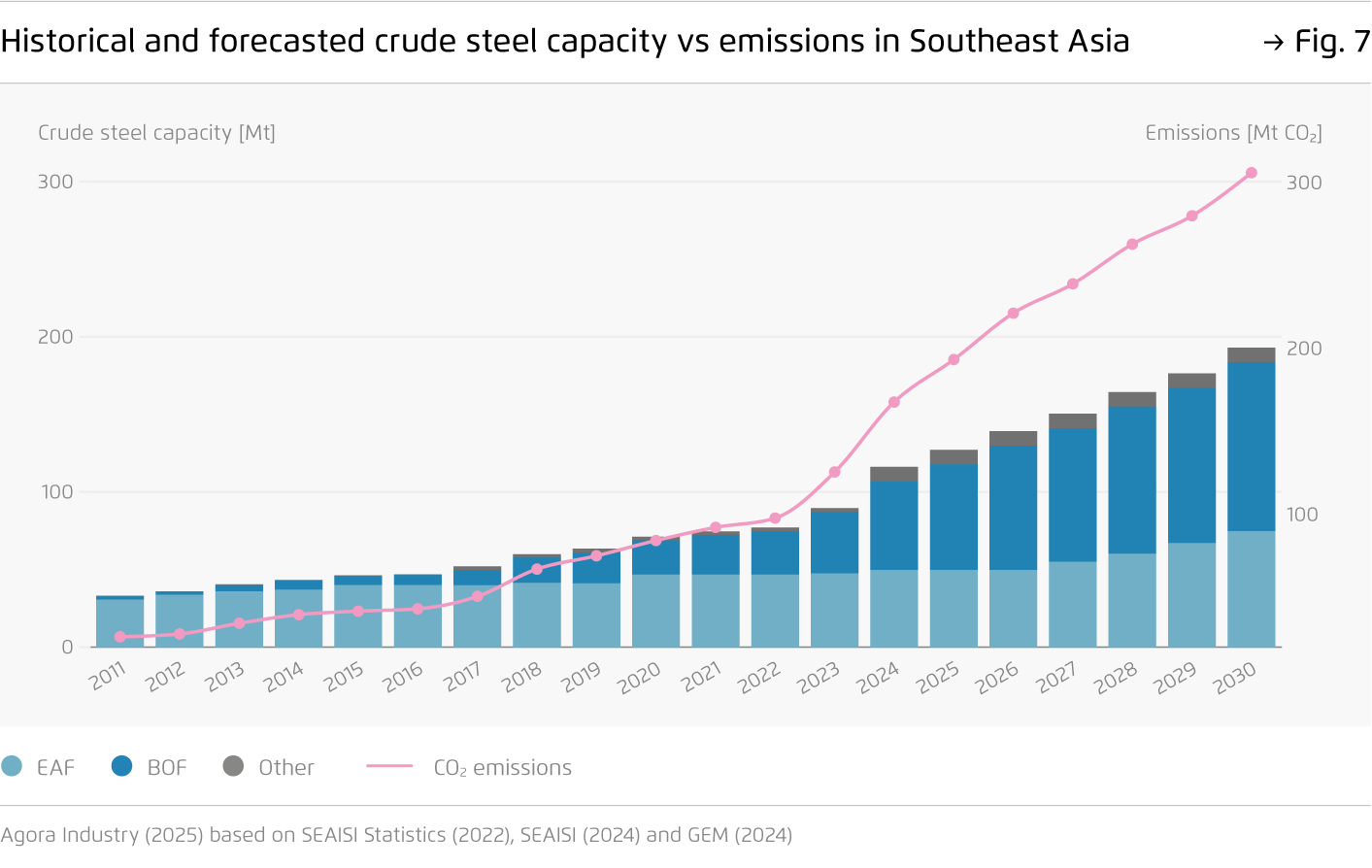

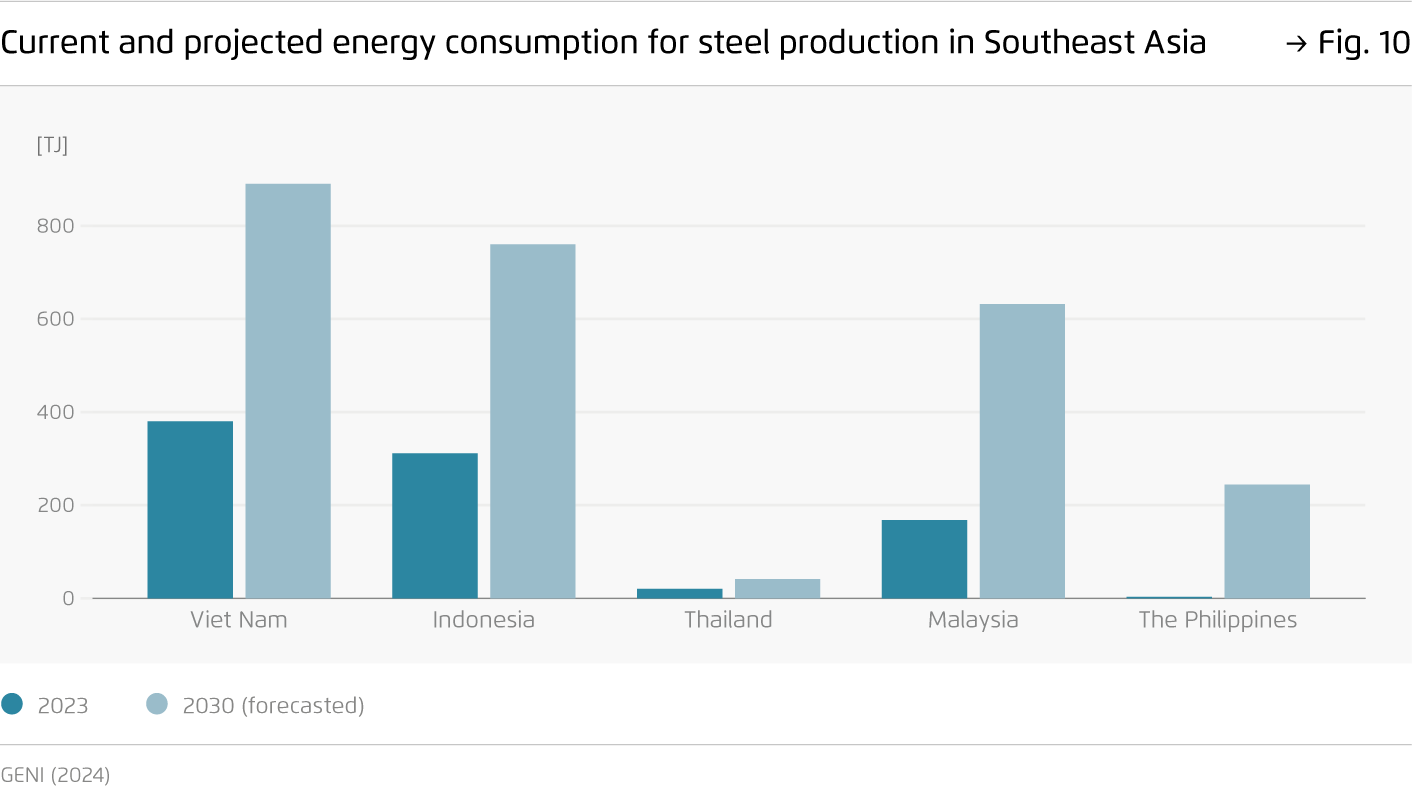

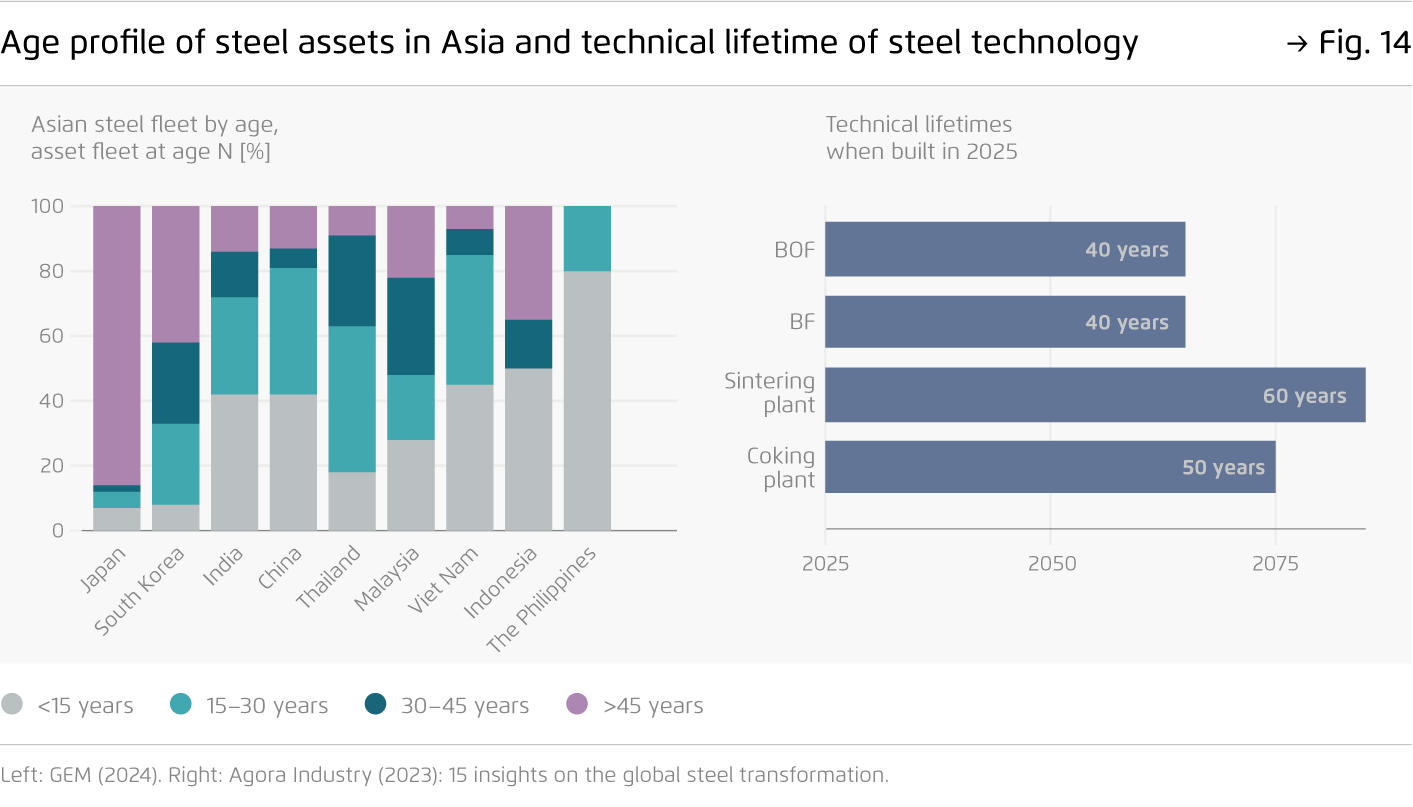

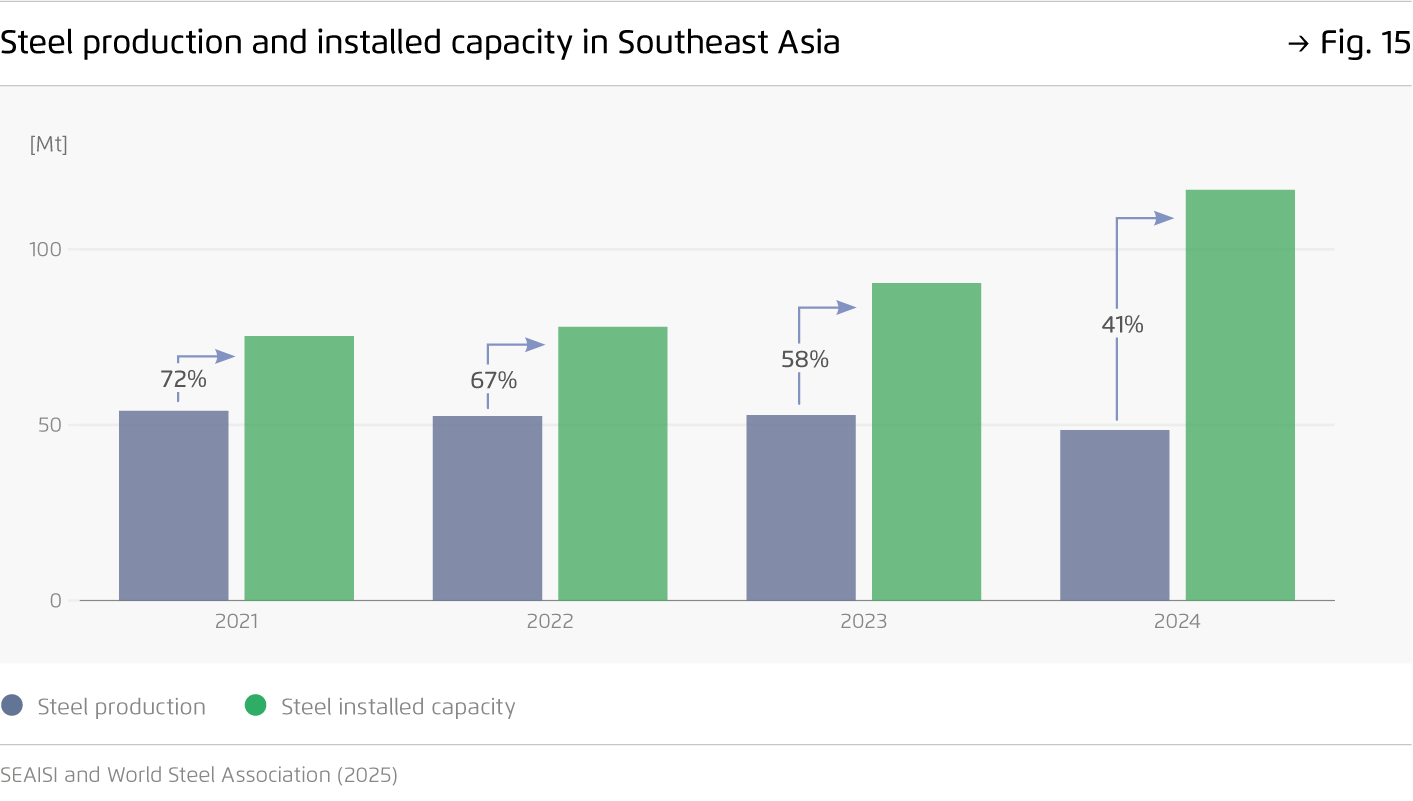

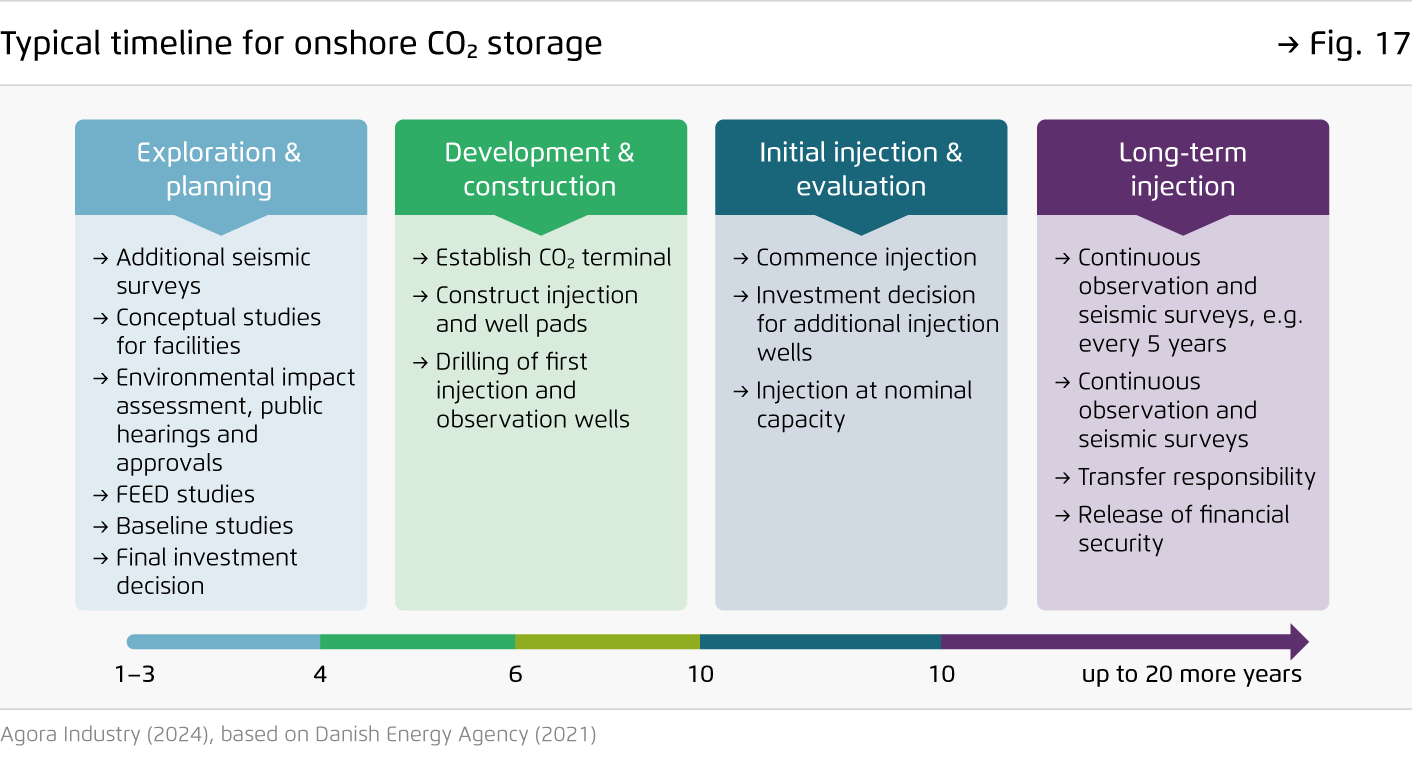

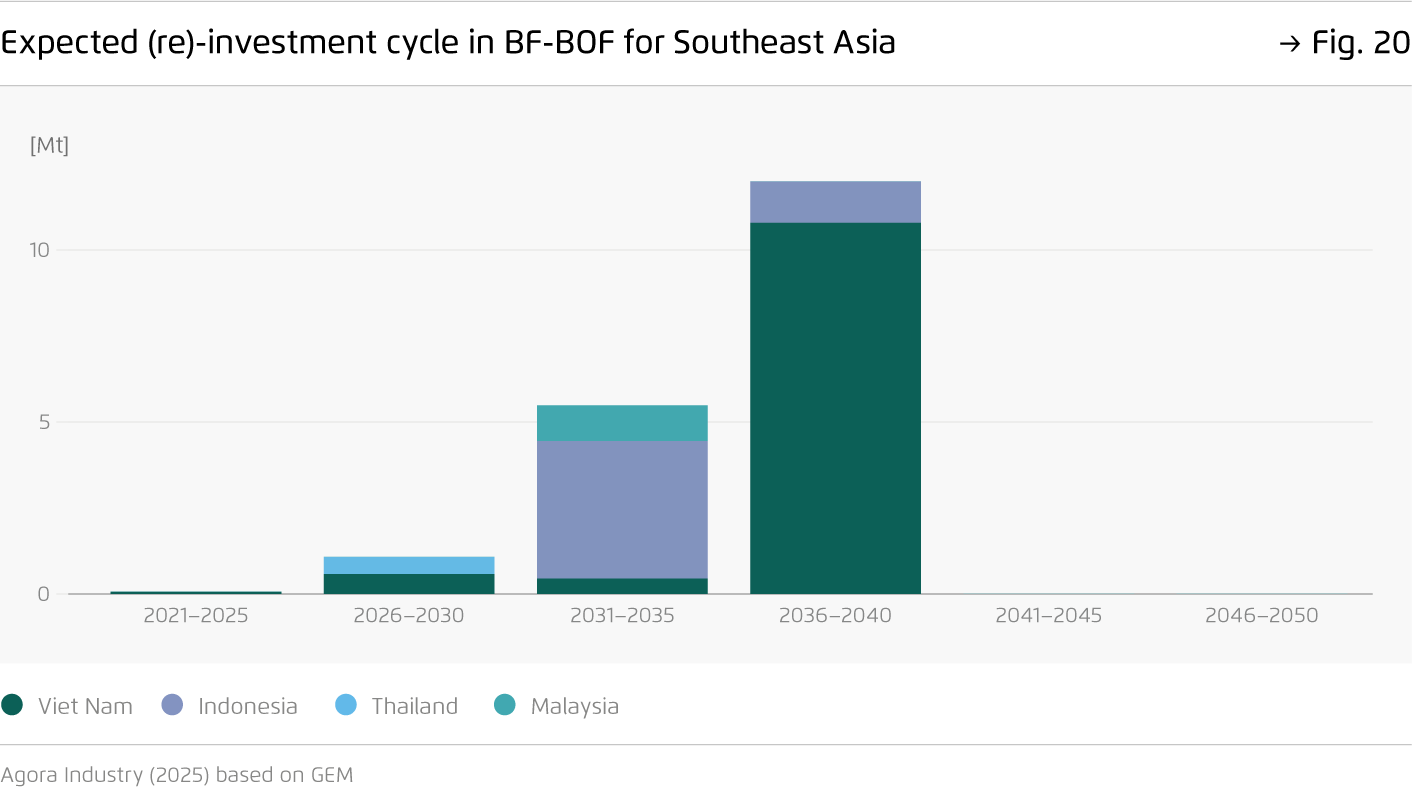

Output is rising in Indonesia, Malaysia, Thailand, the Philippines, and Viet Nam, driven by domestic demand and exports. Yet production remains coal-dependent, with emissions set to double to over 300 Mt CO₂ by 2030. With over 90 percent of blast furnaces needing reinvestment by 2040, the region has a critical window to shift to low-emission steel.

-

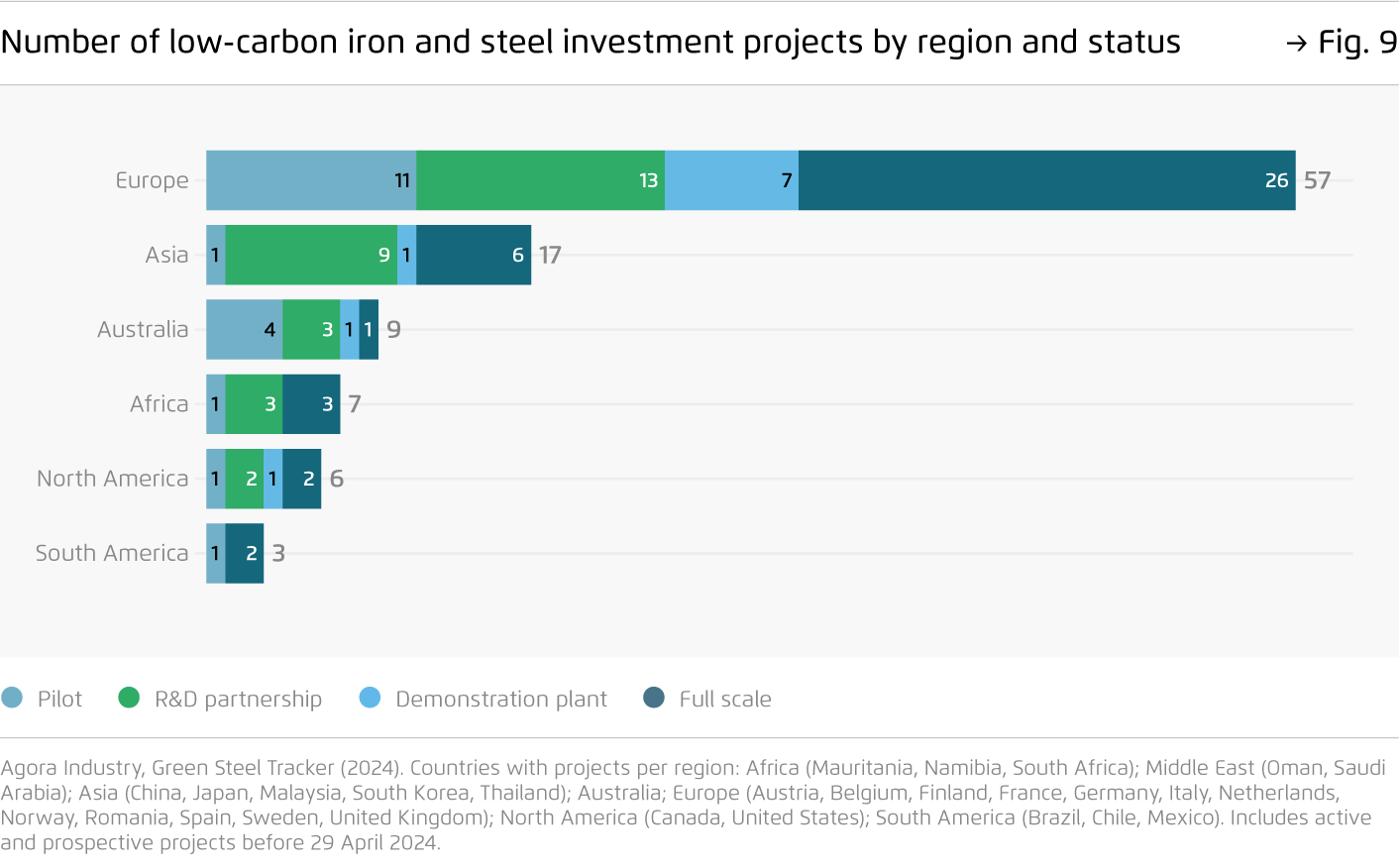

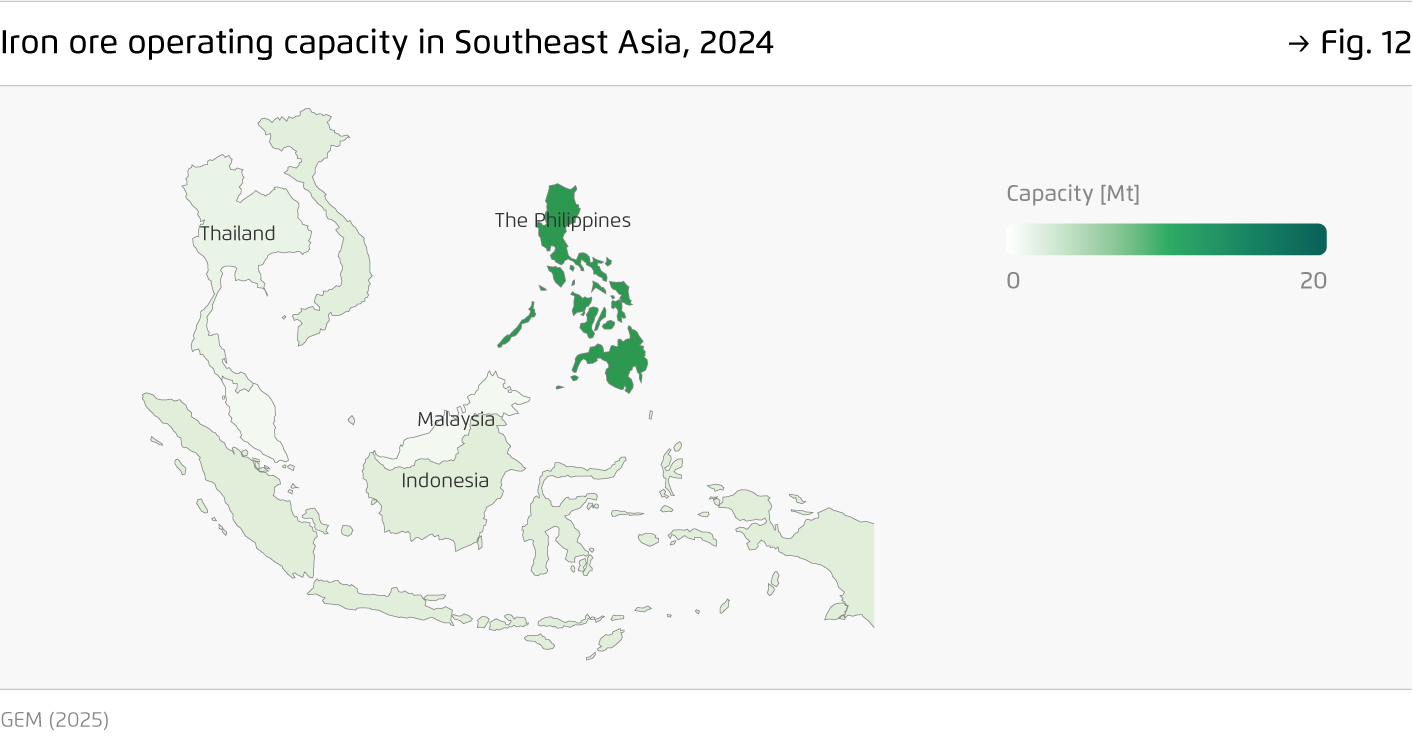

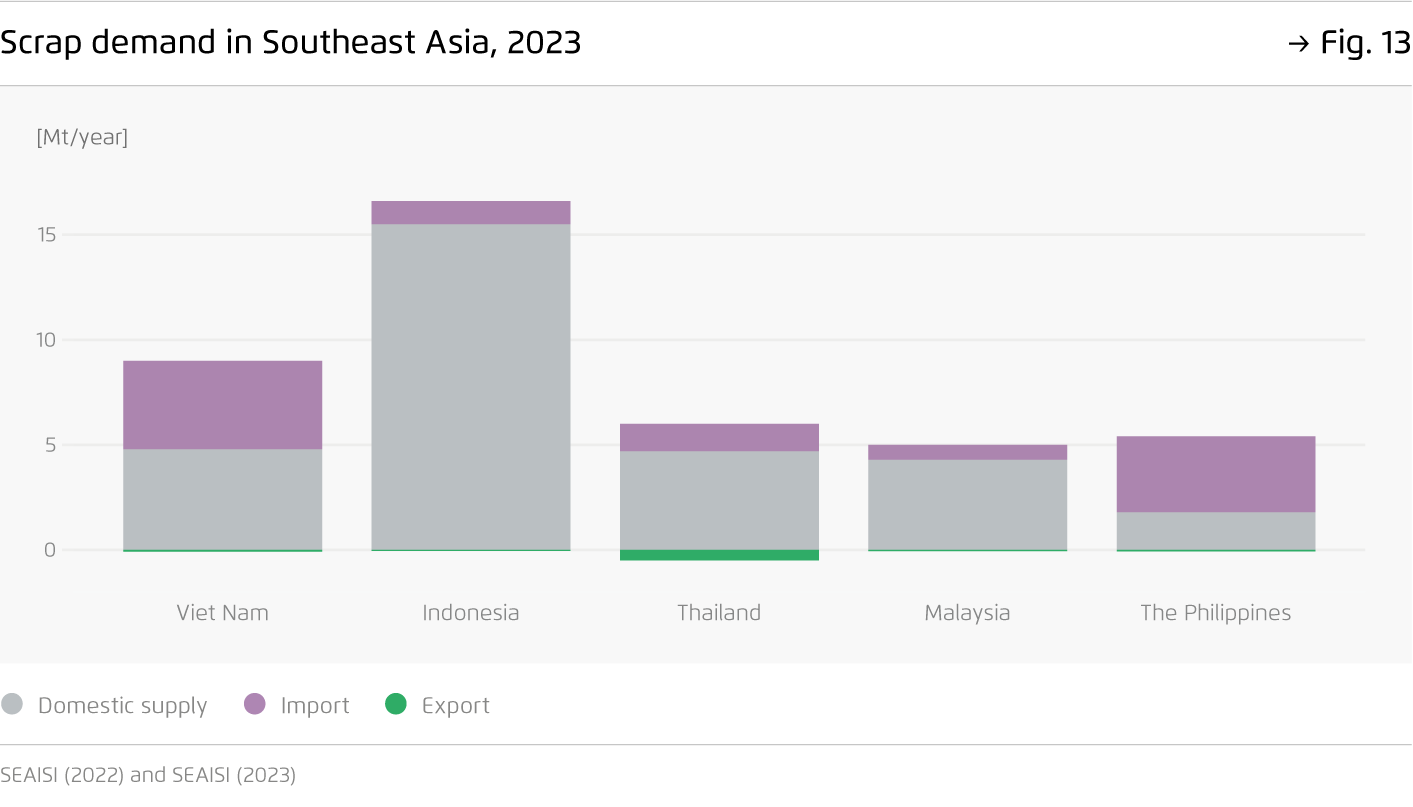

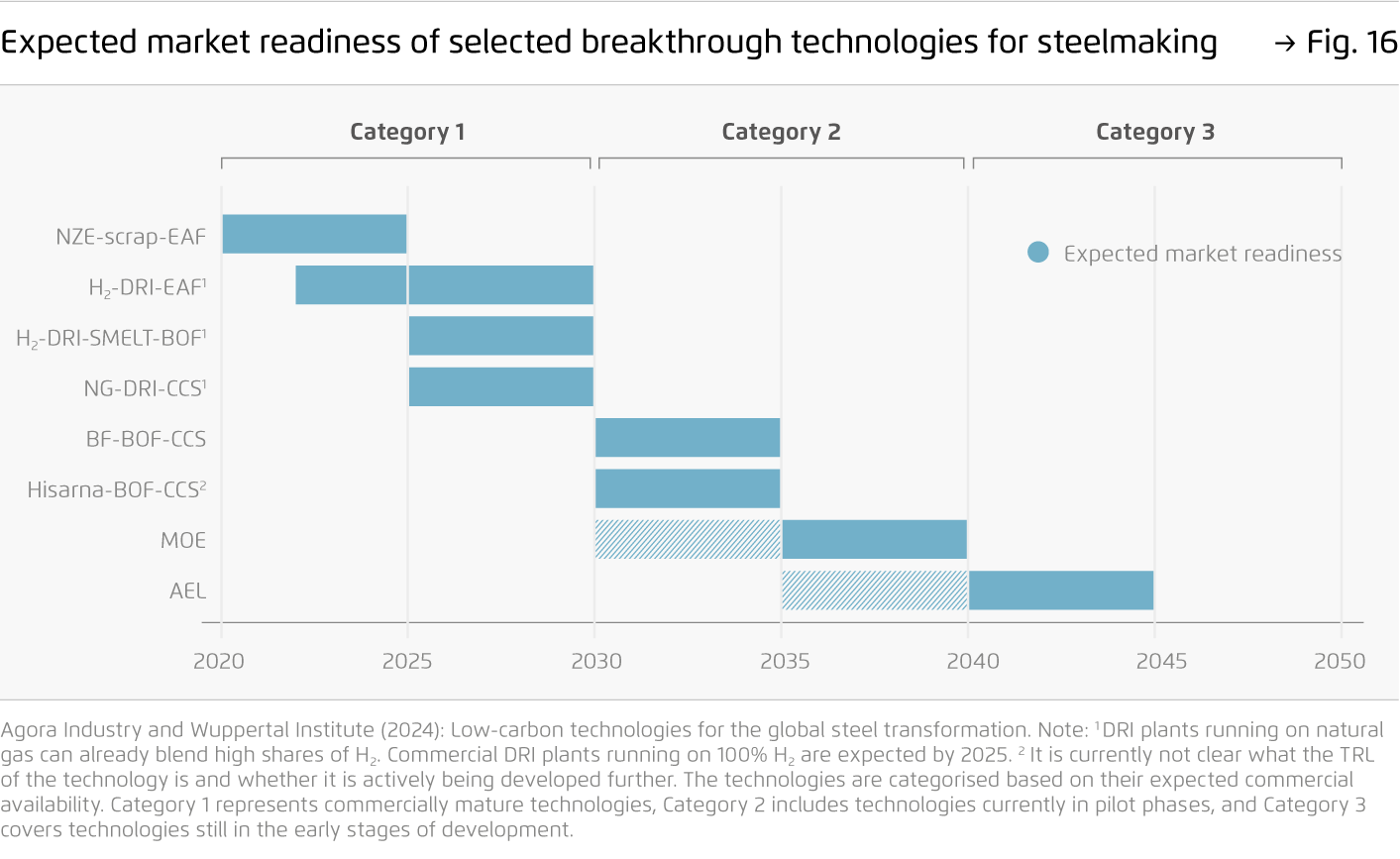

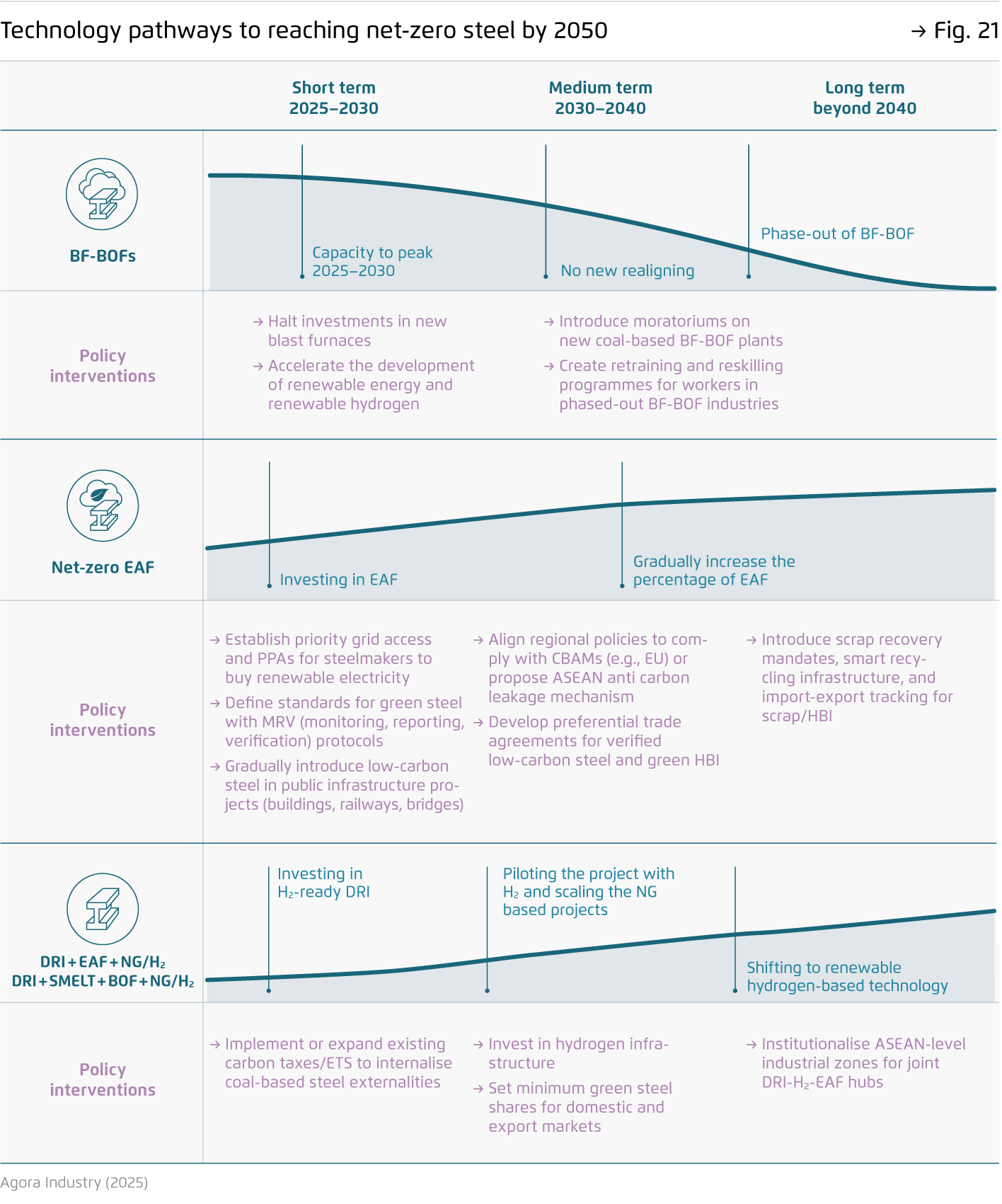

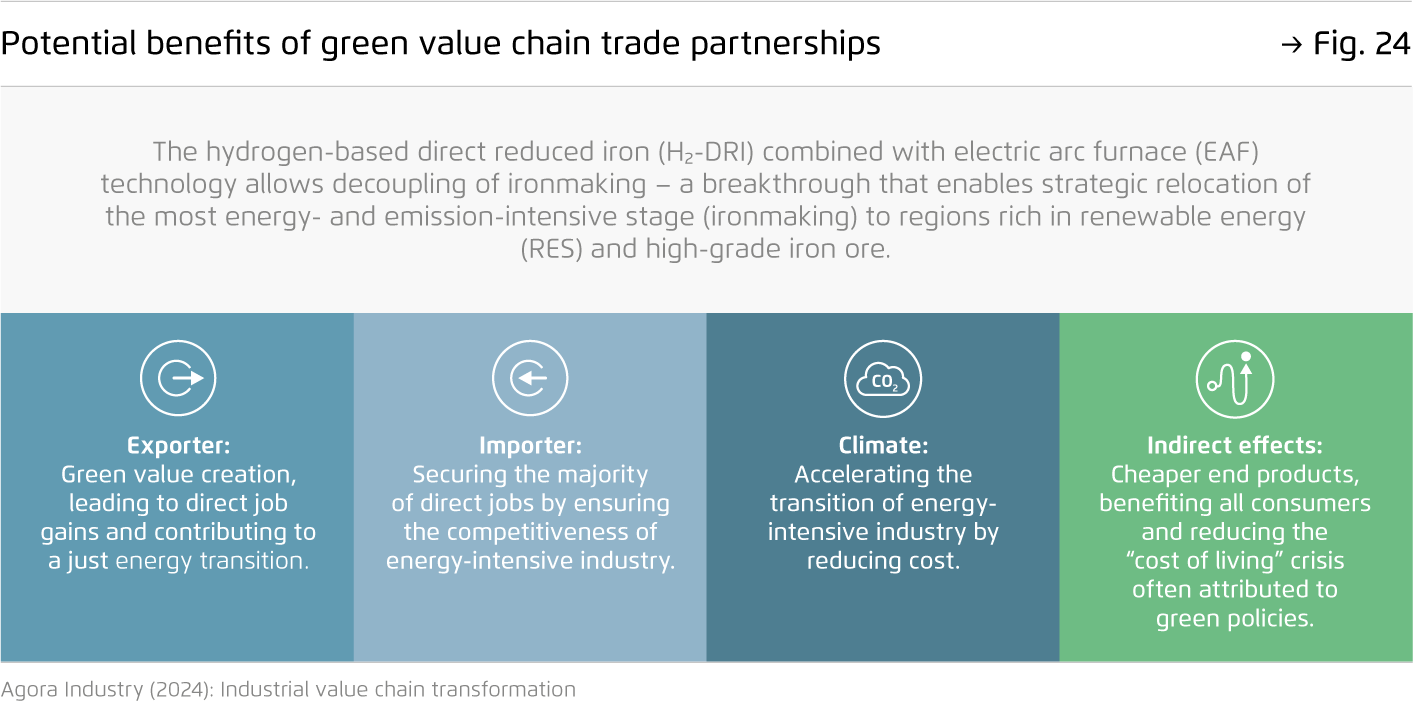

Southeast Asia’s steel sector can transition to low-carbon production through gradual investments in clean technologies, such as scrap-fed electric arc furnaces and hydrogen-based direct reduced iron.

Compared to the current trajectory, this path would avoid 120 Mt CO₂ by 2040 and strengthen local industrial resilience while enhancing competitiveness against low-cost import and carbon border tariffs.

-

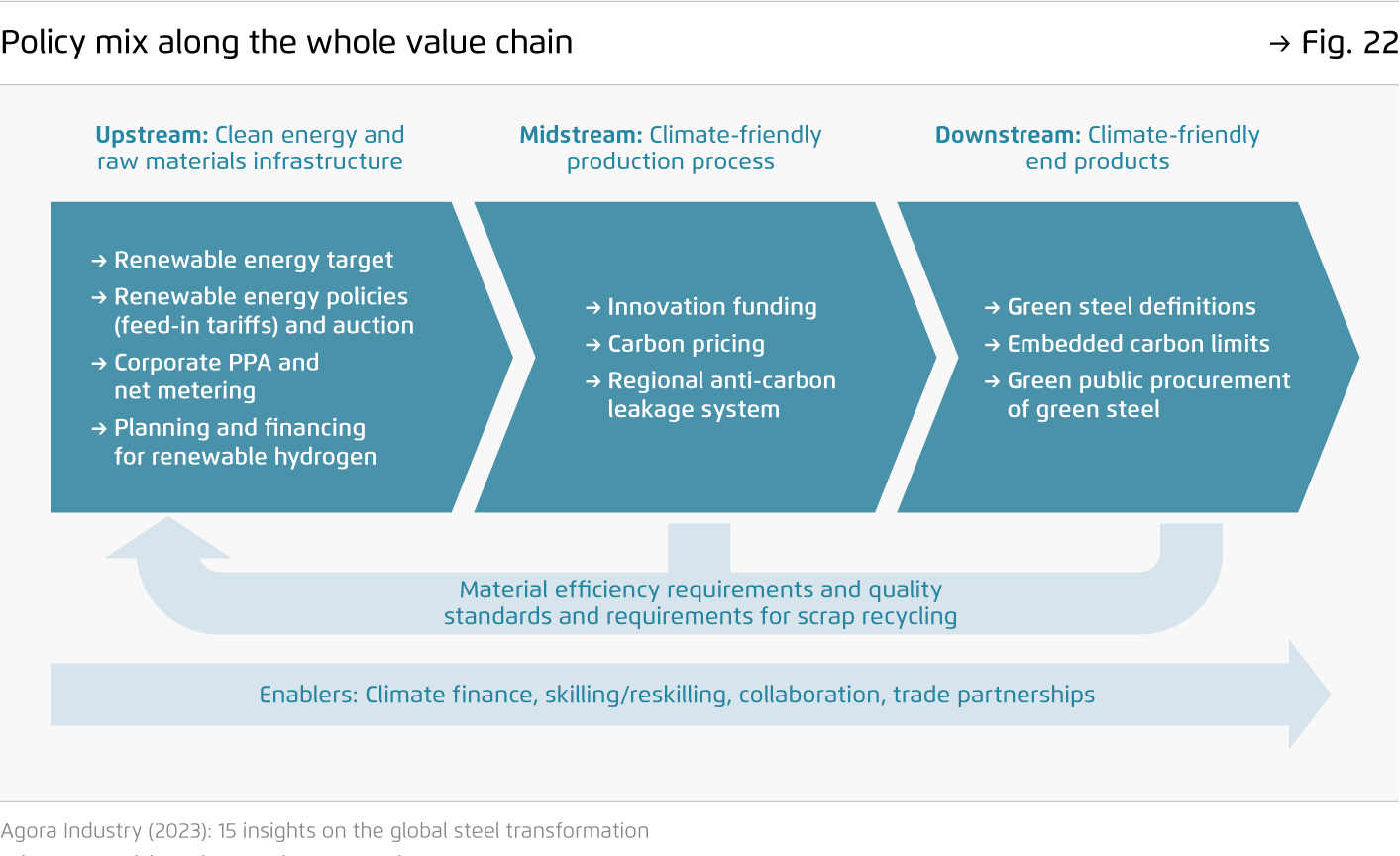

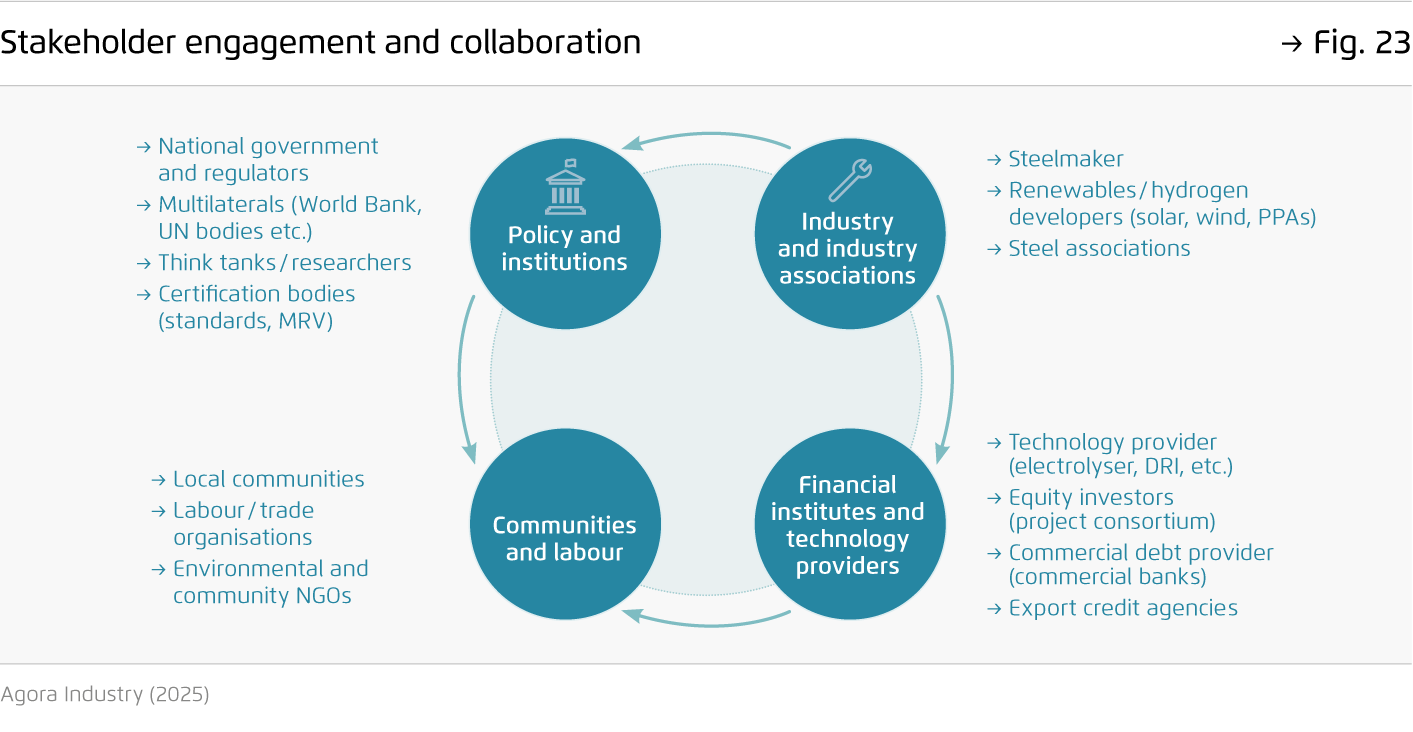

Joint efforts between governments and industry is key to build a competitive low-carbon steel sector in Southeast Asia.

Governments play a key role in setting policies to expand renewable energy and hydrogen, and in stimulating market demand through green public procurement, while industry is responsible for scaling up net-zero technologies such as electric arc furnaces (EAF) and direct reduced iron (DRI). A value chain approach can establish the region as a global hub for low-carbon steel production, driving economic growth and attracting global investment.

-

A unified ASEAN strategy is vital to support the region’s development amid geopolitical and market pressures.

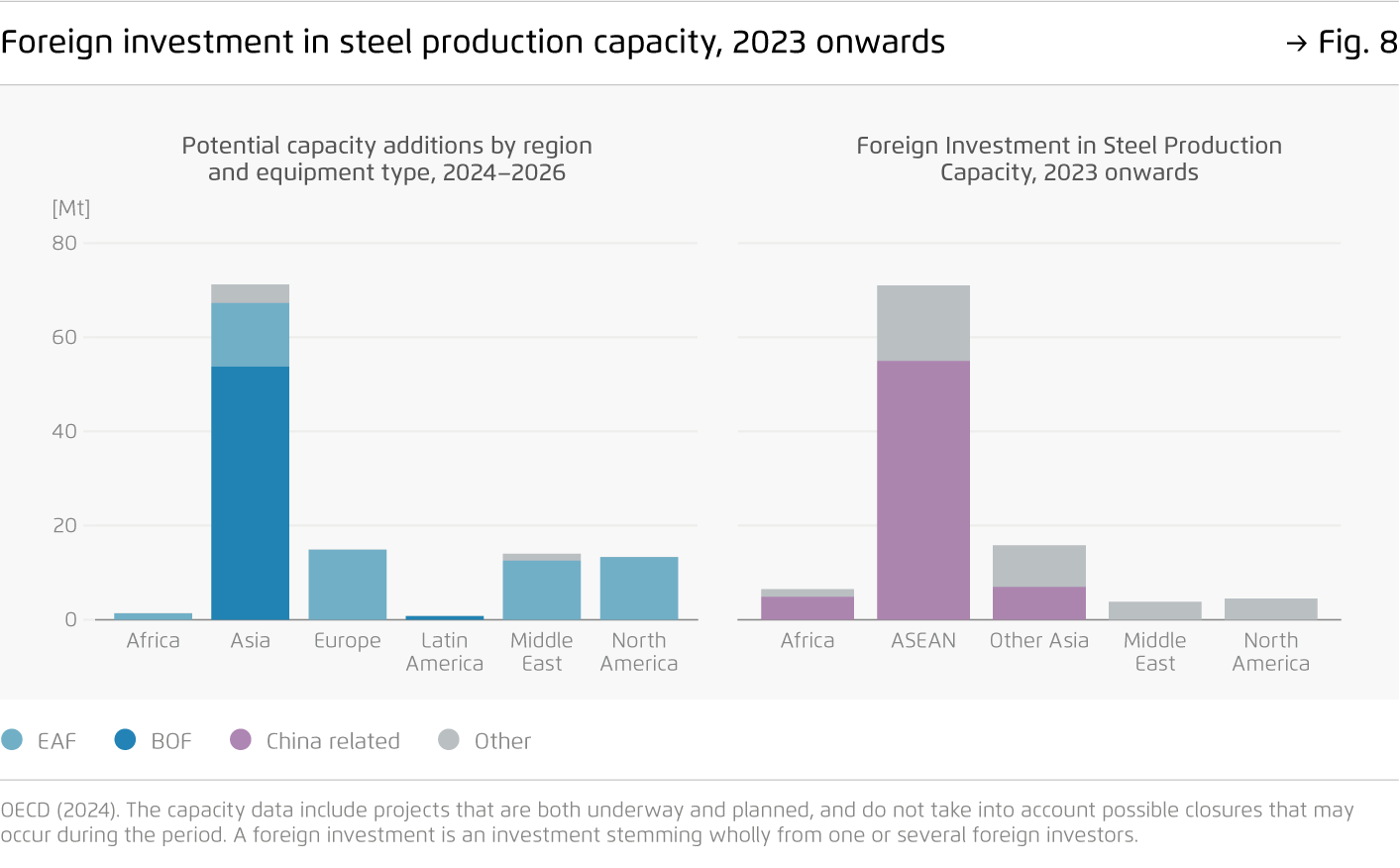

Regional collaboration can pool resources, strengthen supply chain resilience, and speed up decarbonisation. Deeper engagement with China, Japan, and South Korea through ASEAN+3 can address shared infrastructure and investment challenges, aligned with climate goals.

Decarbonising steel in Southeast Asia

Pathways, opportunities and enablers

Preface

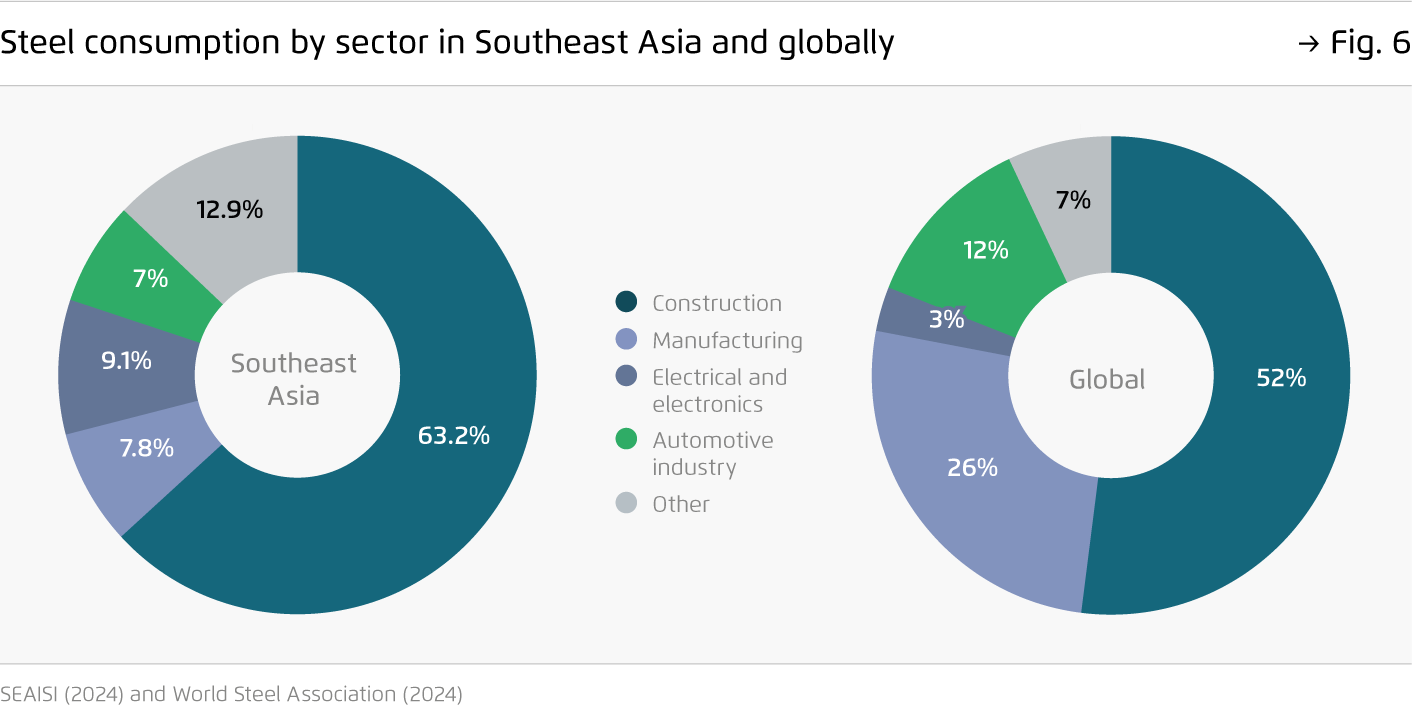

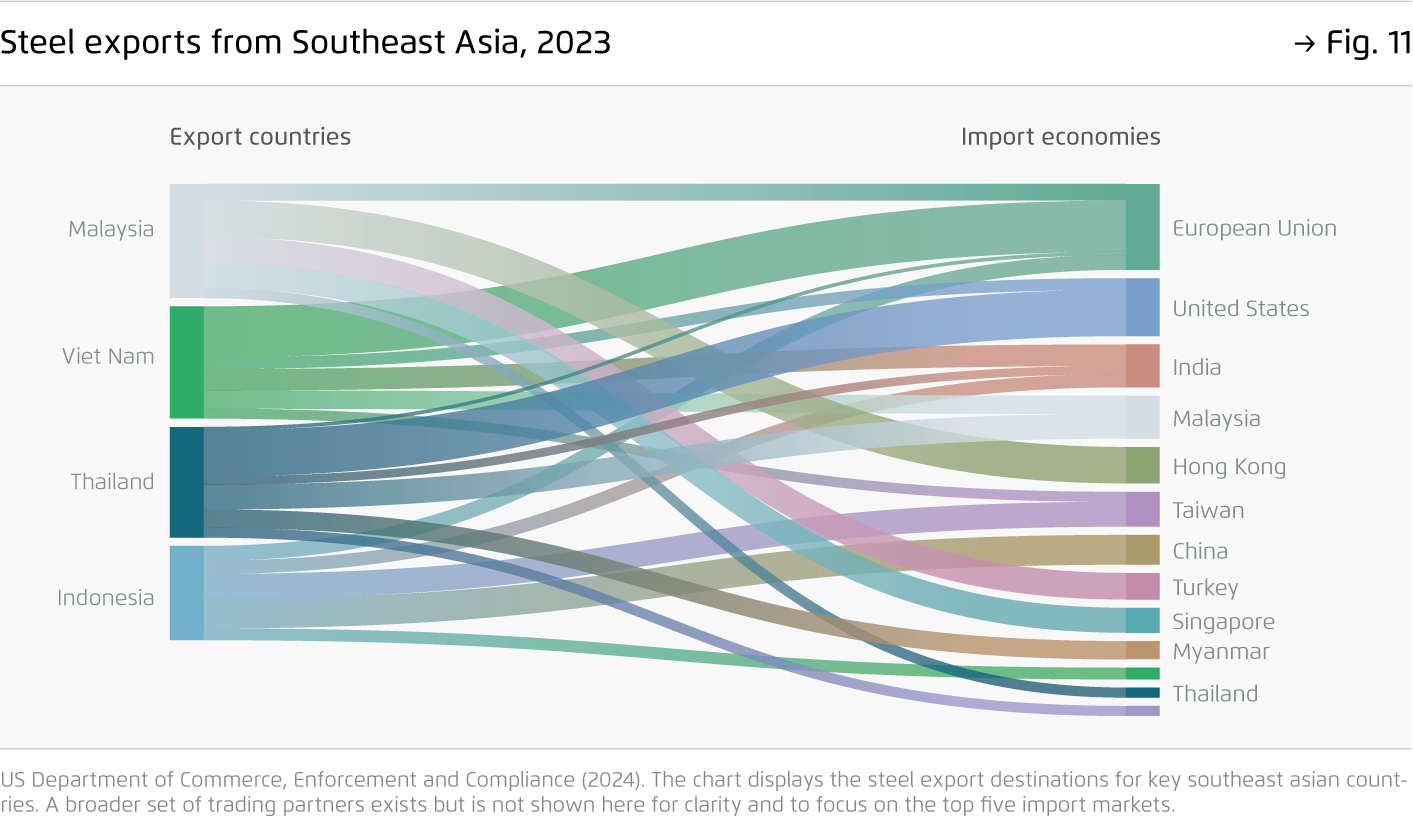

Over the past three decades, the five most steel-intensive Southeast Asian countries – Indonesia, Thailand, Viet Nam, Malaysia and the Philippines – have emerged as important players in the global steel sector, contributing three percent of global steel production. Rapid industrialisation and infrastructure development have significantly increased regional steel demand, while production in Southeast Asian countries has quadrupled over this period.

However, the region has seen a surge in emission- intensive steel manufacturing investments, with steel sector emissions having almost doubled within the last five years. This highlights the urgent need to curb emissions, especially in the carbon-intensive steel sector.

As global trade dynamics evolve and low-cost steel imports grow, the Southeast Asian steel sector finds itself at a crossroads – either it continues to rely on fossil fuels, or it seizes the chance to lead with green technologies of the future. Policymakers now have a unique window of opportunity to shape this transition by aligning industrial growth with climate goals.

This paper provides a comprehensive analysis of the steel sector and sets out a clear roadmap for how Southeast Asia’s steel industry can achieve technically and economically viable net-zero emissions by the 2050s – supporting both regional and global decarbonisation goals while sustaining economic growth.

Key findings

Bibliographical data

Downloads

-

Analysis

pdf 2 MB

Decarbonising steel in Southeast Asia

Pathways, opportunities and enablers

All figures in this publication

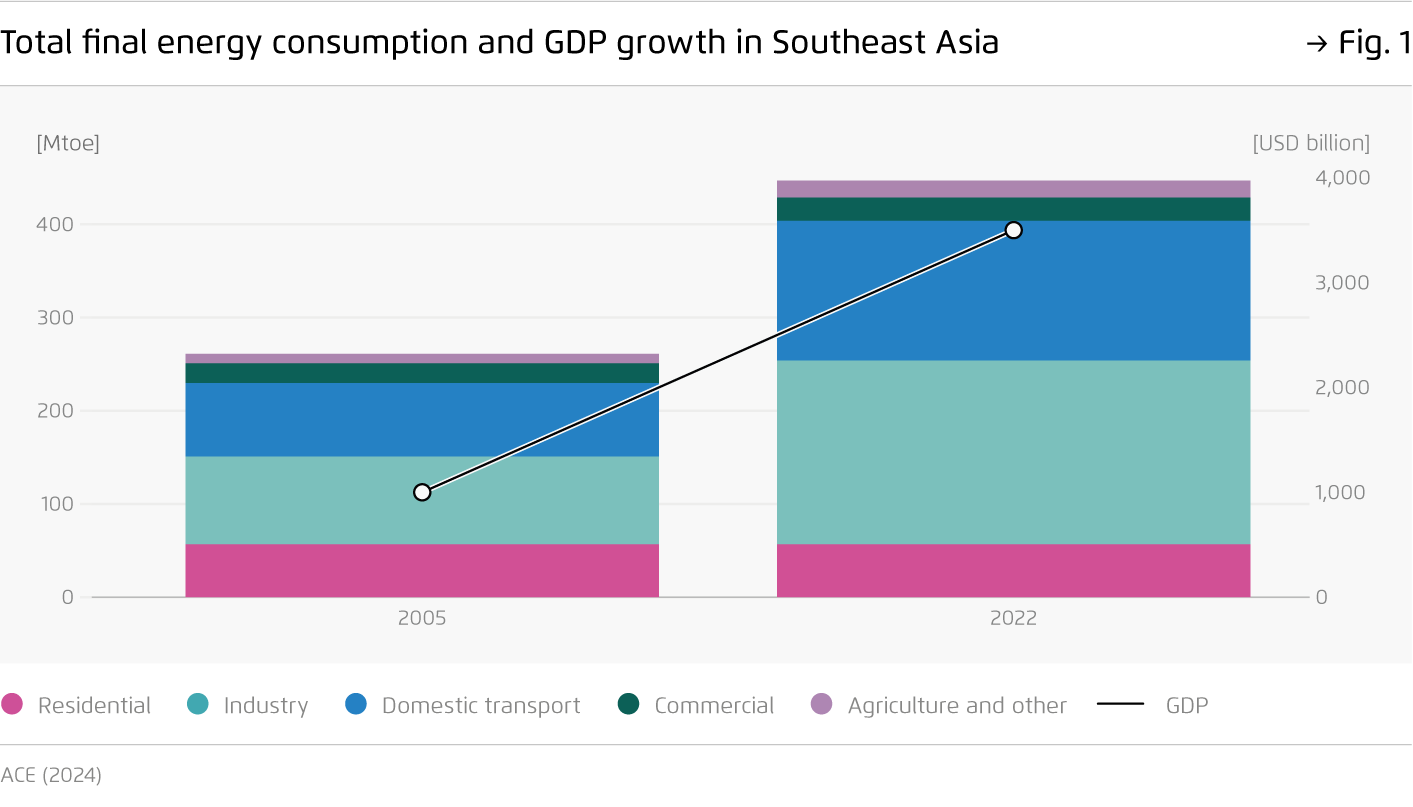

Total final energy consumption and GDP growth in Southeast Asia

Figure 1 from Decarbonising steel in Southeast Asia on page 7

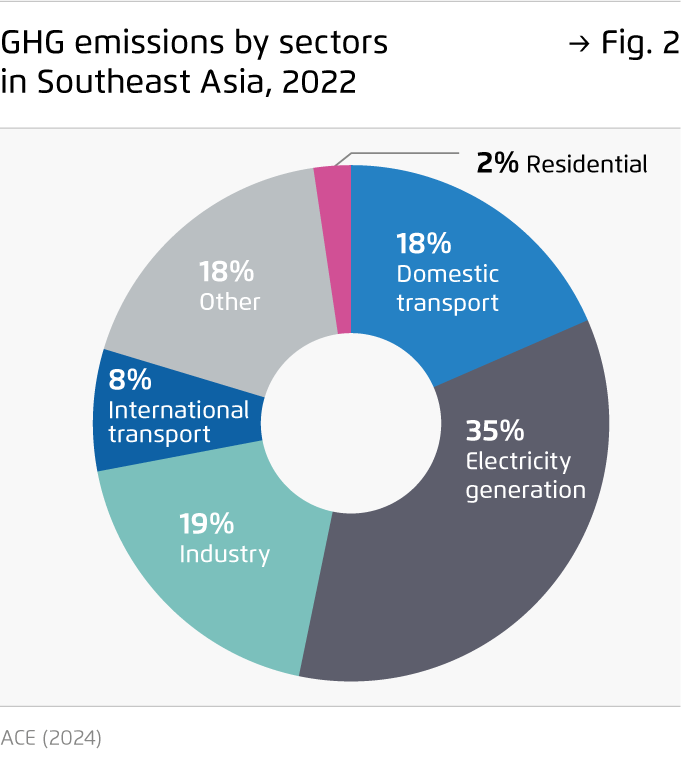

CO₂ emissions by sectors in Southeast Asia, 2022

Figure 2 from Decarbonising steel in Southeast Asia on page 8

![The global steel industry can achieve net-zero emissions by the early 2040s [Translate to English:]](/fileadmin/_processed_/8/f/csm_15_insights_global_steel_news_73f640a802.jpg)

![Shifting global steel reinvestments from coal to clean [Translate to English:]](/fileadmin/_processed_/9/e/csm_global-steel_project_news_2_283e600f74.jpg)