Southeast Asia’s steel industry has key decarbonisation opportunity as 2040 reinvestment window nears

With 90 percent of coal-burning blast furnaces due for reinvestment by 2040, a shift to low-carbon steelmaking technologies could avoid 120 million tonnes of CO₂ and strengthen Southeast Asia’s global competitiveness. Unlocking this potential will require a phased transition away from coal-based processes, supported by policy reforms and regional cooperation, a new analysis by Agora Industry and Agora Energiewende shows.

Bangkok, 24 July 2025. The global steel industry, a key driver of economic growth, accounts for about seven to eight percent of global greenhouse gas emissions. In Southeast Asia, steel production has quadrupled over the past three decades, making the region a major hub for steel manufacturing. Yet steel production remains coal-reliant, with its carbon emissions projected to double to over 300 million tonnes by 2030.

A new analysis by Agora Industry and Agora Energiewende finds that a shift to low-carbon technologies in the sector could avoid 120 million tonnes of CO2 by 2040, corresponding to about half of the annual emissions of Thailand. A phased transition from coal-based steelmaking, supported by policy reforms and regional collaboration would also help attract climate finance and build long-term resilience.

“With shifting global trade and rising low-cost import competition, Southeast Asia’s steel sector faces a fundamental choice: yesterday’s fossil fuels or tomorrow’s low-carbon technologies. The next 15 years provide policymakers and industry a unique window of opportunity to drive this transition together, shaping a future where industrial growth aligns with climate goals,” said Dr. Julia Metz, Director of Agora Industry.

The report focuses on Indonesia, Malaysia, Thailand, the Philippines and Viet Nam, five countries with fast-growing steel demand and production. In 2024, their combined steel output reached approximately 79 million tonnes, roughly equivalent to the total production of the United States. Viet Nam and Indonesia are now among the world’s top 15 producers of steel, with 22 million tonnes and 17 million tonnes of output, respectively.

A phased strategy for a triple win

The report outlines key challenges and practical strategies to address them to align industrial growth with Southeast Asia’s climate and development goals. It highlights how a phased strategy towards clean steelmaking could deliver a triple win for countries like Indonesia and Viet Nam, home to many relatively new but carbon-intensive steel plants: help avoid massive carbon emissions, enhance the economic resilience of local industries and improve export readiness.

This approach involves an immediate halt to the development of new, carbon-intensive Basic Oxygen Furnace (BOF) plants to address overcapacity and emissions, and instead boosting investment in scrap-fed Electric Arc Furnaces (EAFs) as a proven, lower-emission alternative. To meet future demand sustainably, the strategy also calls for gradually building out plants capable of hydrogen-based Direct Reduced Iron (DRI). This approach embraces a flexible technology that can run on fossil gas before switching to green hydrogen as it becomes available – a model already being adopted in Thailand.

“Embracing new technologies powered by renewable energy allows Southeast Asia’s steel sector to respond to global measures like carbon tariffs and ensure long-term sustainability. With a strategic approach to investments, the region can transform its steel industry into a resilient and competitive player on the global market,” said Metz.

Creating lead markets is essential to stimulate demand for low-carbon steel

The report further emphasises that transforming Southeast Asia’s steel industry hinges on adopting a smart and coordinated policy mix at the national level, implemented consistently across the entire value chain. This strategic approach is fundamental for attracting potential national and international climate finance as well as securing the industry’s long-term competitiveness.

Creating lead markets through incentives such as green public procurement can play a catalytic role in building domestic demand for low-carbon steel. Construction and the emerging electric vehicle sector offer promising starting points, as both are poised for growth and can drive early adoption of green materials. In parallel, carbon pricing mechanisms can help level the playing field and strengthen market signals.

“Blended finance, carbon pricing and well-designed policy support can help reduce investment risks and encourage industry uptake of clean technologies. Over time, coordinated regional efforts will be important to support Southeast Asia’s transition to low-carbon steel and maintain its competitiveness in a changing global landscape,” said Metz.

Regional cooperation can accelerate and scale national efforts

The report explores how regional collaboration can drive a comprehensive transformation by building on existing national frameworks. Developing a unified low-carbon steel strategy at the Southeast Asian level, along with harmonising standards and regulations across member states, can help the region unlock opportunities for industrial decarbonisation, the report shows.

Furthermore, extending this cooperation to key trading and investment partners, such as China, Japan and South Korea via ASEAN+3, can help overcome challenges of the transition. Such collaboration is crucial for mitigating stranded asset risks, facilitating technology transfer, ensuring access to suitable iron ore, promoting green iron trade and co-developing the critical infrastructure necessary for the deployment of low-carbon hydrogen and renewable energy.

The 50-page report titled Decarbonising steel in Southeast Asia: Pathways, opportunities and enablers, by Agora Industry and Agora Energiewende, is available for free on our website.

![The global steel industry can achieve net-zero emissions by the early 2040s [Translate to English:]](/fileadmin/_processed_/8/f/csm_15_insights_global_steel_news_73f640a802.jpg)

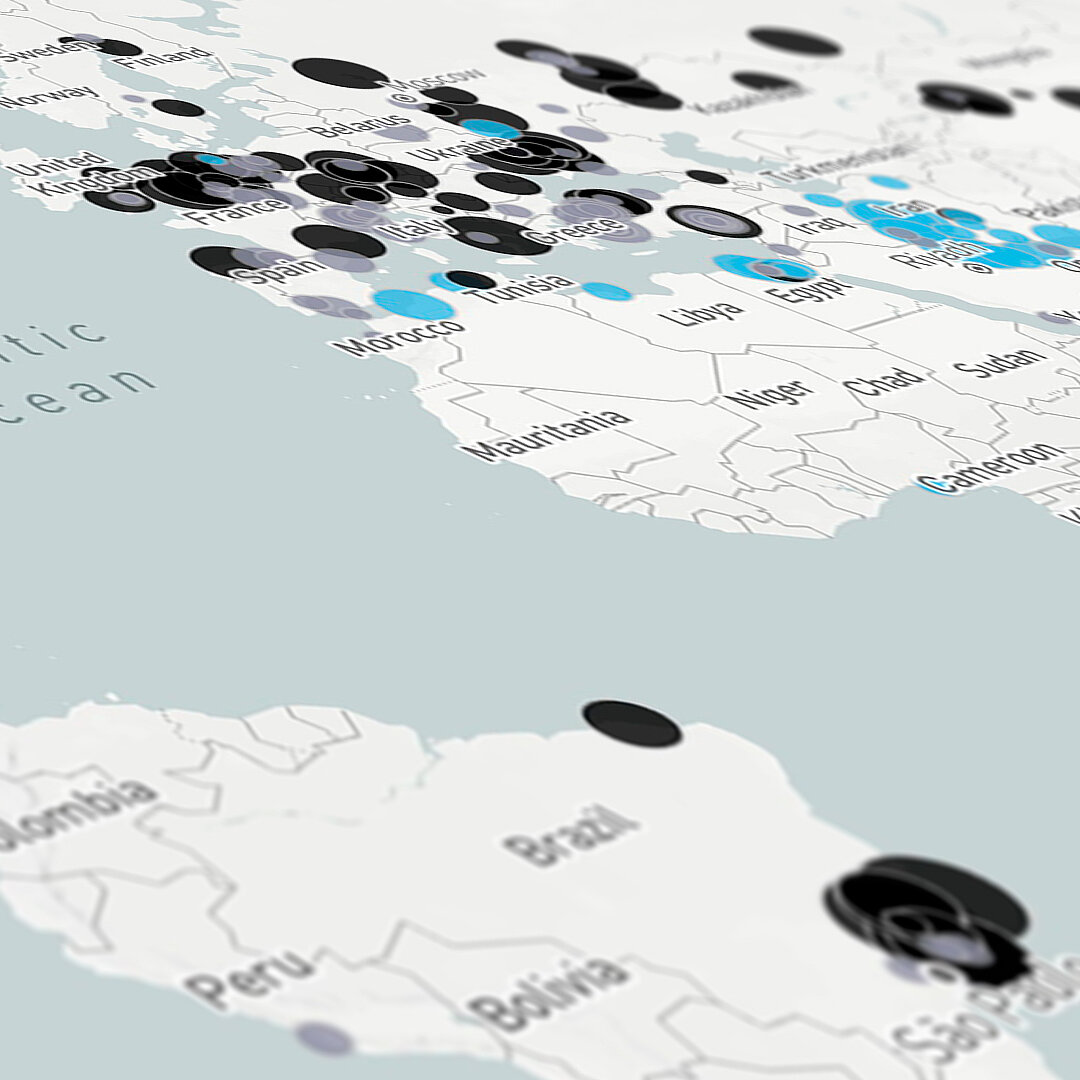

![Shifting global steel reinvestments from coal to clean [Translate to English:]](/fileadmin/_processed_/9/e/csm_global-steel_project_news_2_283e600f74.jpg)