The global steel industry can achieve net-zero emissions by the early 2040s

The phase-out of coal in steelmaking, a swift roll-out of clean technologies and the creation of an international green iron trade can put the global steel industry on a 1.5°C-compatible emissions reduction pathway. This transformation requires targeted regulatory frameworks and expanded international cooperation.

Berlin, 15 June 2023. It is technically feasible for the global steel sector to reach net-zero greenhouse gas emissions by the early 2040s, a new study by think tank Agora Industry and research institute Wuppertal Institute finds. This can be achieved through strategic investment in key technologies such as direct reduced iron (DRI), a coal phase-out in steel production and by establishing a green iron trade.

“Our study shows that it is time to remove the ‘hard-to-abate’ label from the steel industry”, said Frank Peter, Director of Agora Industry. “The technologies and strategies required to reach net zero are already there – now governments and companies need to combine their efforts to deploy them fast.”

The key levers to decarbonise the global steel sector are a higher material efficiency, a significant increase in scrap-based steelmaking; as well as kick-starting hydrogen-based steelmaking. Furthermore, through bioenergy in combination with carbon capture and storage (BECCS), the steel industry has the potential to generate more than 200 million tonnes of negative emissions per year by 2050.

The study provides two scenarios for 1.5°C-compatible steelmaking which focus on different technological pathways: one scenario applies a wide range of clean steelmaking technologies, and the other scenario focuses on the accelerated roll-out of DRI after 2030. Both scenarios are technically feasible if governments and industry take rapid action. This includes removing major technological bottlenecks such as engineering and construction capacities, ramping up key technologies and infrastructure, and putting in place a targeted regulatory framework.

A phase-out of coal in the steel sector by the early 2040s is technically feasible

The study’s two scenarios demonstrate that a phase-out of coal in steelmaking by 2043 and 2045 respectively is technically feasible. This could not only help reduce the direct CO2 emissions of the steel industry, but also eliminate the large footprint of the steel industry that results from coal mine methane leakage.

“If the steel sector was a country, it would be the third largest CO2 emitter and the second largest coal consumer,” says Frank Peter. This is why the accelerated decarbonisation of the sector is so important, and can be a key element in raising global climate ambition.”

The study finds that for existing coal-based blast furnaces, a coal phase-out by 2043 would not lead to any premature shutdowns. However, as there is a large project pipeline of new coal-based steel plants in emerging economies, it is crucial to address potential carbon lock-ins and stranded assets, especially since betting on carbon capture and storage (CCS) at a later stage is risky.

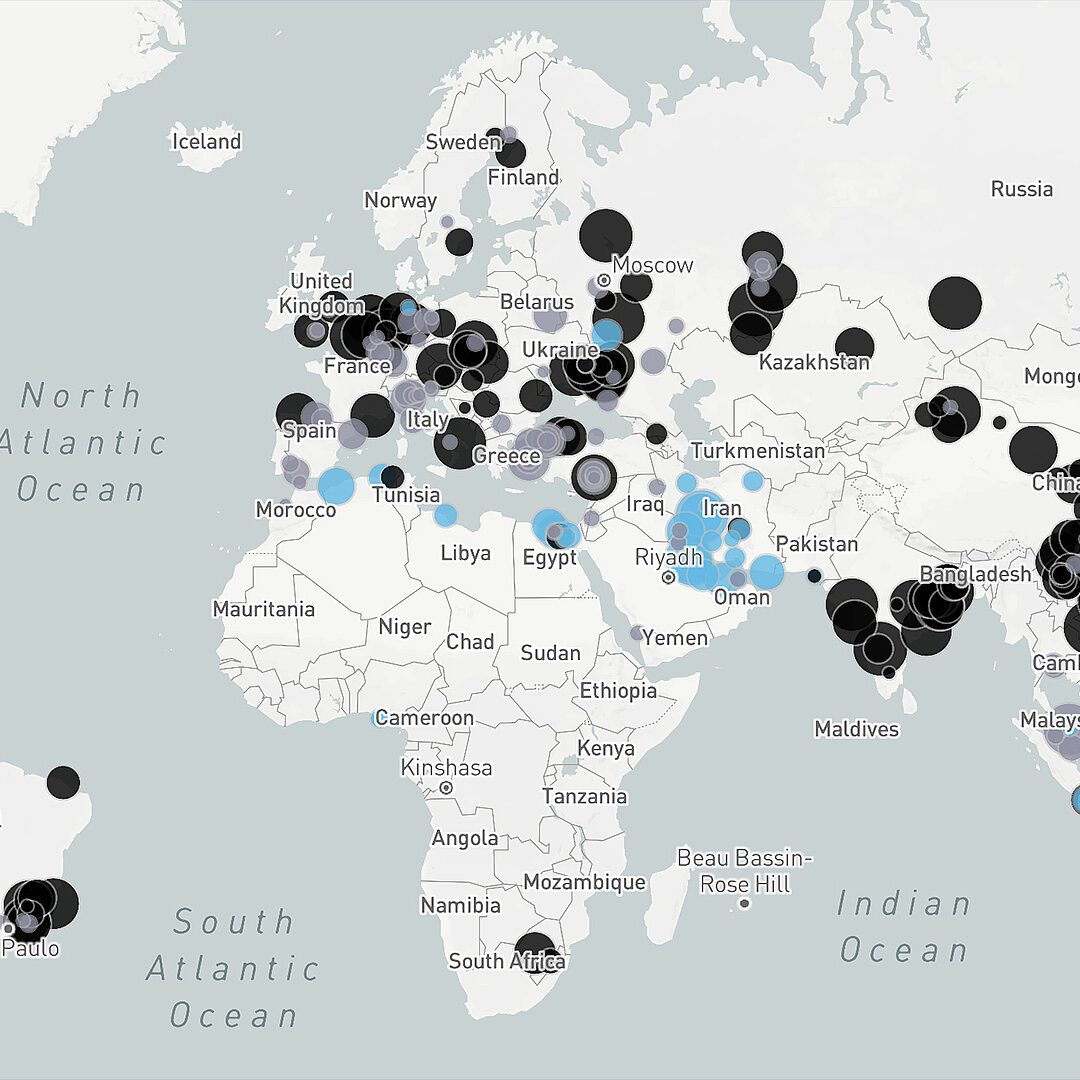

Thus, international cooperation is needed to ensure a shift in investments from coal to clean. This includes climate finance for emerging economies, de-risking policies to lower the costs of capital, non-distortive trade agreements and joint technology development. The cooperation requires the buy-in and participation of local communities to ensure a fair and equitable transition.

Uncertain future for carbon capture and storage (CCS) in coal-based steel production

So far, CCS in combination with coal-based steelmaking technologies has been an integral part of virtually all major steel decarbonisation scenarios. But current market trends and a combination of risk factors put into question whether CCS on coal-based blast furnace basic oxygen route (BF-BOF) will have an important role in the global steel transformation.

Agora estimates that CCS on the coal-based BF-BOF route is unlikely to reduce direct CO2 emissions beyond 73% and cannot address upstream emissions such as coal mine methane leakage. Compared to other key technologies, steelmakers’ efforts to commercialise this technology are also very low. While the 2030 pipeline for commercial-scale CCS on the BF-BOF route amounts to just 1 Mt, the project pipeline of H2-ready direct reduced iron (DRI) plants has grown to 84 Mt over the last three years.

The deployment speed of DRI technology will set the pace of the global steel transformation

DRI is a flexible steelmaking technology that enables the production of near-zero emissions steel. Agora estimates that with current engineering and construction capacities around 70 Mt of additional H2-ready DRI capacity could be built by 2030, which amounts to only roughly half of the 120 to 150 Mt of additional DRI capacity required by 2030 for a 1.5°C compatible pathway. One key solution to address this DRI capacity bottleneck would be to retrain engineers and construction workers to build DRI plants. Another solution is to facilitate the entry of new players in the H2-based DRI technology market.

International green iron trade can lower costs and be a win-win for importers and exporters

The cost of low-carbon hydrogen will have a major impact on the future competitiveness of steelmakers. Due to various energy and conversion losses in the transport chain, importing liquid hydrogen or ammonia by ship will likely never be a competitive option for hydrogen-based steelmaking. For steelmakers eyeing overseas hydrogen imports, a significantly cheaper option will be to import embodied hydrogen in the form of green iron (i.e. hot briquetted iron).

Many of today’s major iron ore-exporting countries such as Brazil, South Africa, Australia, and Canada are projected to have comparatively low production costs for renewable hydrogen. Instead of exporting iron ore and hydrogen and its derivatives by ship for steelmaking, those countries could export green iron, which could create additional local jobs and an increase in value added.

For countries with high renewable hydrogen costs, green iron imports can increase the competitiveness of low-carbon steelmaking, which helps to safeguard the vast majority of local jobs in the steel industry. Strategic global partnerships will be required to launch green iron trade and ensure a win-win for both importing and exporting countries.

A comprehensive policy framework across the whole value chain is necessary

The policies and measures needed to kick-start the steel sector transformation include ensuring clean energy and raw materials through proper planning and financing of renewable energy, hydrogen, carbon capture and storage infrastructure, in addition to robust sustainability criteria for hydrogen and biomass.

“The 2020s are a major crossroads for the global steel sector. The right policy and investment decisions today will avoid high carbon lock-in and stranded assets and put us on the path of net-zero compatible investments that can future-proof the industry and its jobs,” Peter concluded.

Governments can support and incentivise climate-friendly production processes through financing instruments such as carbon contracts for difference, sufficient funding for innovation and carbon pricing and adequate carbon leakage measures. Finally, defining green steel, setting limits on embodied carbon and adopting green public procurement practices can help uptake climate-friendly products.

The study "15 Insights on the Global Steel Transformation" provides 1.5°C-compatible pathways to an accelerated steel transformation. It was produced in collaboration with the Wuppertal Institute. The publication is available for free download below.

![Shifting global steel reinvestments from coal to clean [Translate to English:]](/fileadmin/_processed_/9/e/csm_global-steel_project_news_2_283e600f74.jpg)